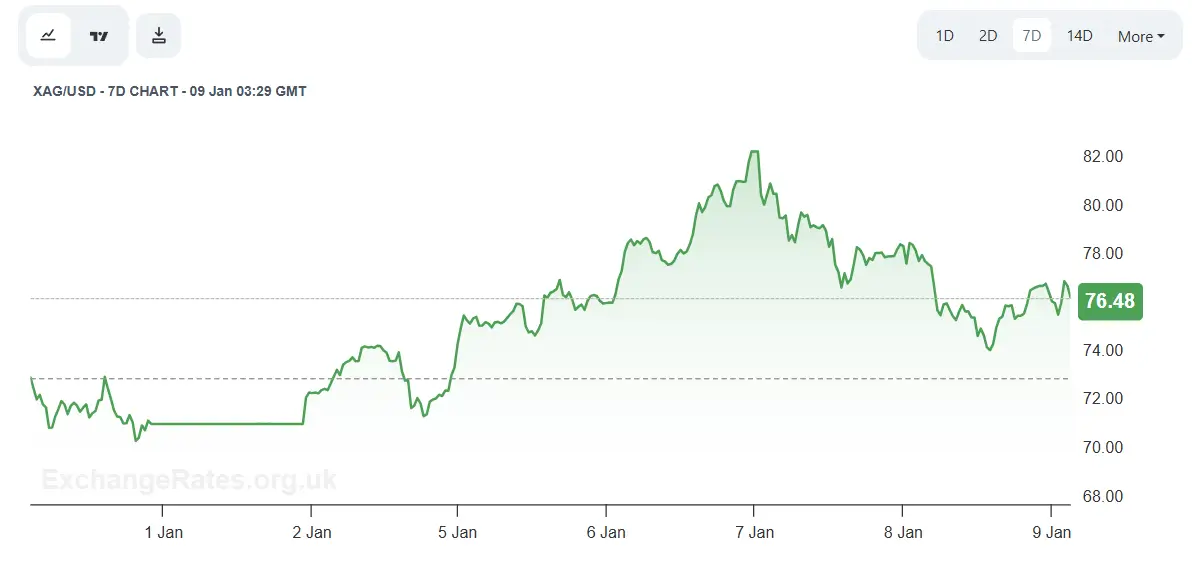

Silver prices edged lower on January 9, 2026, as the precious metals market entered a short-term correction phase following the strong rally recorded at the end of 2025. During the Asian trading session, XAG/USD traded around the $76.5–77.5 per ounce range, reflecting increased selling pressure from short-term investors.

Market participants pointed to profit-taking activity, combined with a moderate recovery in the US dollar, as key factors weighing on silver prices. Rising US Treasury yields also reduced the appeal of non-yielding assets such as precious metals.

Despite today’s decline, analysts note that silver remains historically elevated, supported by long-term demand from industrial sectors, particularly renewable energy, electronics, and electric vehicle production.

On the international market, silver struggled to maintain momentum after failing to break above recent resistance levels. Technical indicators suggest that XAG/USD is undergoing a healthy consolidation, rather than a full trend reversal.

Key drivers influencing silver prices today include:

Short-term technical corrections after an extended rally

Strengthening of the US dollar

Cautious investor sentiment ahead of upcoming macroeconomic data

Some market strategists believe silver could experience heightened volatility in the coming weeks, as global supply constraints and industrial demand continue to shape price movements.

Domestic silver prices followed the global trend, posting slight declines across major trading hubs:

Hanoi & Ho Chi Minh City: Approximately VND 2,390,000 – 2,430,000 per tael, depending on purity and dealer

Silver bars (1kg): Prices adjusted downward in line with international spot movements

Local traders reported stable demand, though buyers remain cautious amid short-term price fluctuations.

Looking ahead, analysts expect silver prices to move sideways or remain volatile in the near term. While macroeconomic uncertainty and currency movements may cap upside momentum, strong industrial demand and limited global inventories continue to support silver’s long-term outlook.

Investors are advised to closely monitor:

US inflation and interest rate signals

Dollar index movements

Industrial demand trends for precious metals

| Market | Silver Price |

|---|---|

| Global (XAG/USD) | ~$77 per ounce |

| Vietnam (Retail) | ~VND 2.39 – 2.43 million per tael |

Info Finance