Share

Homepage

News

3 Reasons AMD Stock Still Makes a Solid AI Play

3 Reasons AMD Stock Still Makes a Solid AI Play

01 tháng 8 2024

Source: JHVEPhoto / Shutterstock.com

Advanced Micro Devices (NASDAQ:AMD) is one of the key AI chip bets investors can make. The American chipmaker and AMD stock have been successful underdogs in the computing power space.

More than a decade ago, Intel (NASDAQ:INTC), with its model of manufacturing its chips, dominated the CPU market. However, after several delays in manufacturing down to smaller node sizes, Intel eventually fell behind, and AMD gladly took advantage of the opportunity.

AMD is playing an increasingly important role in the world of AI chips, and the AI “craze” has driven the chipmaker’s shares higher for the past 12 months. The market has been in the midst of a whirlwind, but there are still reasons to be bullish on AMD.

Forget Nvidia, Buy Elon Musk’s AI Supplier. It Could Be the Hottest AI Stock of 2024.

AMD Is Still a Hot Stock

The possibility of investor fatigue over artificial intelligence has been bubbling underneath the surface for some months now. After the release of OpenAI’s ChatGPT, many software firms rushed to employ large language models (LLMs) to develop generative AI features for their respective products. With all that investment, it’s unclear whether it has paid off. A report from Bloomberg asserts, “For most big application software companies, AI-related sales won’t appear on the profit-and-loss statements till next year — or the year after that.”

As a result, investors are beginning to tire from waiting for the AI-related profits to generate.

Last week, the Nasdaq 100 lost $1 trillion in market value after an AI fatigue rout drove shares of major tech stocks downward. AMD was also hit. However, unlike many software stocks pouring money into setting up AI features, AMD is on the opposite side of the fence and will be essential to supply the chips that make these features work. The point is that just because investors might be tired of the AI craze, software companies will likely continue to make capital investments in AI, which will be a long-term tailwind for chipmakers like AMD.

AMD Made Meaningful AI Chip Advancements

Chipmaker Nvidia (NASDAQ:NVDA) has received most of the attention in the AI chip space, which makes sense given Nvidia’s near-monopoly on advanced accelerators. AMD’s latest AI chips for training LLMs are behind Nvidia’s Blackwell chips, but they are steadily catching up.

At the Computex conference in Taiwan, AMD announced the new accelerator that will be available towards the end of 2024. CEO Lisa Su said, “The expanded roadmap includes the AMD Instinct MI325X accelerators, with planned availability in Q4 2024, delivering industry-leading memory capacity with 288GB of ultra-fast HBM3E memory that extends AMD generative AI performance leadership.”

AMD claims these chips will outperform Nvidia’s most popular H100 and H200 chips, decreasing Nvidia’s performance lead in the space.

The Big Tech players seem to welcome AMD’s entrance into the market. Microsoft’s (NASDAQ:MSFT) CEO Satya Nadella, for example, has praised how AMD’s MI300X accelerators deliver “leading price/performance” for Microsoft Azure workloads.

Selling Pressure Made AMD Cheaper

AMD took a big hit in July in terms of stock performance. The chipmaker’s shares plummeted 13% since the beginning of the month. AMD was by no means immune from last week’s tech equities rout. Moreover, heightened tensions between the U.S. and China, which could result in further trade restrictions, also dented chip stocks more broadly.

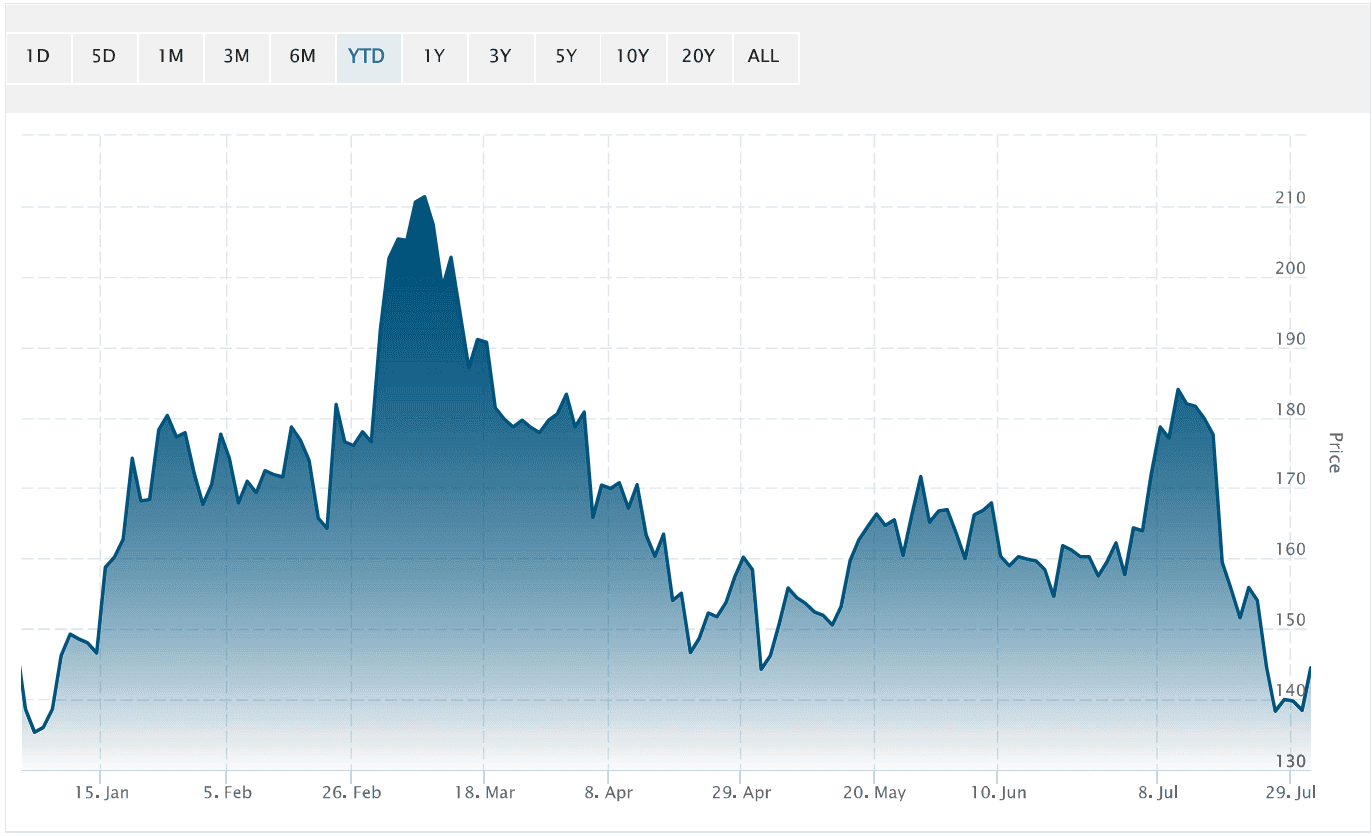

AMD stock price

The American chip maker’s shares slumped around 5% on a year-to-date basis, which means it is underperforming not only Nvidia but also the major market indices. However, investors should be looking for a cheaper valuation. Instead of boasting a forward-looking price-to-earnings multiple above 40x, AMD trades at around 35x forward earnings. This is slightly lower than Nvidia’s current valuation.

In other words, while AMD’s stock is trading down, investors should consider using this moment to buy in or even upsize their investments.

investorplace

All information on our website is for general reference only, investors need to consider and take responsibility for all their investment actions. Info Finance is not responsible for any actions of investors.