Share

Homepage

News

4 Reasons to Buy PDD Stock Like There's No Tomorrow

4 Reasons to Buy PDD Stock Like There's No Tomorrow

30 tháng 8 2024

The Chinese e-commerce leader is still firing on all cylinders.

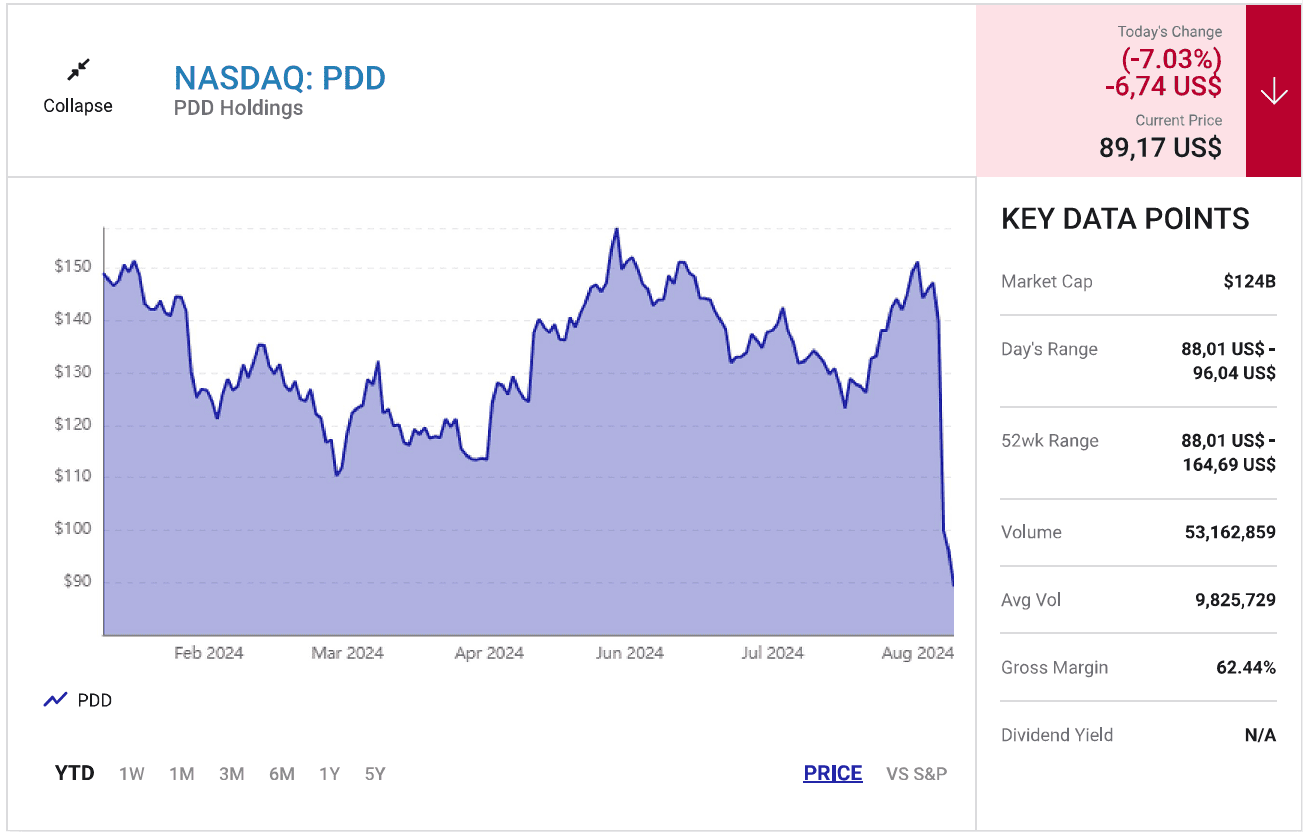

PDD Holdings (PDD -7.03%), one of China's top e-commerce companies, was one of the few Chinese stocks that bucked the sector's ongoing sell-off. Its stock price rallied 80% over the past 12 months, while shares of Alibaba (BABA -2.25%) and JD.com (JD -1.67%) declined 5% and 21%, respectively.

Given the strong performance, some investors might be wondering if there is any more growth left to tap into. Let's review four reasons why PDD is still worth buying today.

1. PDD is China's fastest-growing e-commerce leader

PDD was only founded nine years ago (as Pinduoduo), but it quickly carved out a niche with its discount marketplace, which targeted shoppers in China's lower-tier cities. It encouraged its shoppers to team up on social media channels to score bulk discounts.

PDD then capitalized on its initial growth spurt to launch an online agricultural platform that connected farmers directly to consumers. That farm-to-table channel enabled it to sell fresh produce at much lower prices than traditional supermarkets. It also gave PDD a foothold in the agricultural market, which Alibaba and JD sorely lacked.

From 2018 to 2023, PDD grew its annual revenue at a whopping compound annual growth rate (CAGR) of 80%. In comparison, Alibaba's revenue only rose at a CAGR of 20% from fiscal 2019 to fiscal 2024 (which ended this March), while JD's revenue increased at an even slower CAGR of 19% from 2018 to 2023.

From 2023 to 2026, analysts expect PDD's revenue to grow at a CAGR of 38%. That growth should be driven by its market share gains in China and by Temu, its cross-border marketplace that connects Chinese sellers to overseas buyers.

Analysts expect Alibaba's revenue to grow at a CAGR of 8% from fiscal 2024 to fiscal 2027 as it tries to offset the slowing growth of its Chinese e-commerce marketplaces by expanding its overseas and cross-border marketplaces. They expect JD's revenue to only grow at a CAGR of 5% from 2018 to 2023. We should take those estimates with a grain of salt, but they strongly imply that PDD will remain China's fastest-growing e-commerce leader.

2. PDD's profits are soaring

PDD turned profitable in 2021, and its net income quadrupled in 2022 and nearly doubled in 2023. Its profits skyrocketed as it phased out its lower-margin first-party marketplace, expanded its higher-margin third-party marketplace, and diluted its logistics expenses. Analysts expect its net income to grow at a CAGR of 47% from 2023 to 2026.

Alibaba's e-commerce business operates on a similar third-party model, but its overseas marketplaces operate at much lower margins than its Chinese marketplaces. Alibaba's higher e-commerce margins are also offset by the lower margins of its other businesses. JD still generates most of its revenue from its lower-margin first-party marketplace.

3. PDD isn't being targeted by antitrust regulators

Back in 2021, China's antitrust regulators hit Alibaba with a record $2.75 billion fine and forced it to halt its exclusive deals with merchants and rein in its loss-leading promotions. It was also barred from making big investments and acquisitions without the government's consent. Those new restrictions eroded the market leader's defenses against PDD and JD.

PDD is still China's third-largest e-commerce company by annual revenue, so it hasn't been targeted in a major antitrust crackdown like Alibaba. Its agricultural business was slapped with a minor fine for undercutting neighborhood markets in 2021, but it doesn't face nearly as many regulatory challenges as Alibaba or JD.

4. PDD's stock looks dirt cheap

PDD's stock trades at just 13 times this year's earnings, which is a dirt cheap multiple for a company that could nearly triple its annual profit over the next three years. Alibaba and JD trade at 14 and 9 times this year's earnings, respectively.

The macro challenges in China and the country's tech and trade conflicts with the U.S. are still compressing the valuations of all three of these stocks and many of their industry peers. But if those tensions ease, many value-seeking investors will pivot back toward Chinese stocks -- and PDD will look like a much better buy than Alibaba or JD when that happens.

fool

All information on our website is for general reference only, investors need to consider and take responsibility for all their investment actions. Info Finance is not responsible for any actions of investors.