Share

Homepage

News

AMD stock price target 2025

AMD stock price target 2025

08 tháng 7 2024

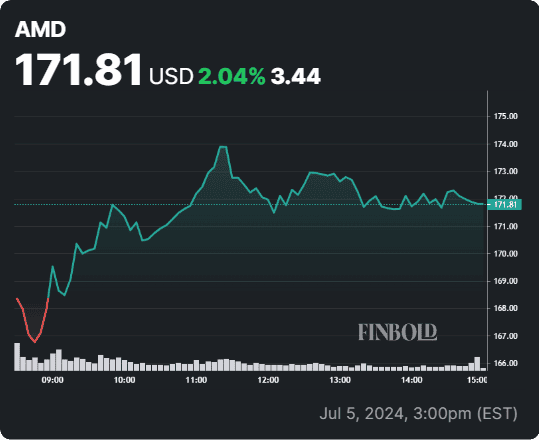

The previous month was pretty favorable for Advanced Micro Devices (NASDAQ: AMD) stock, as it added 7.21% to its value. Wall Street analysts are bullish on its potential upside and room for growth, which is set to be bolstered by the expanding artificial intelligence (AI) landscape.

AMD stock looks set to carry on with gains of 4.88% from the previous trading session, as the pre-market gains show a 0.76% increase in the early morning of July 8.

While it might be hard to predict what the upcoming years hold for AMD shares, the narrative is already forming regarding AMD’s stock price target in 2025.

Move over, Nvidia, 2025 is the time for AMD stock to shine

Wall Street analysts are primarily bullish on Nvidia (NASDAQ: NVDA) stock, but the number of analysts taking a neutral stance increased slightly on Friday. New Street Research analyst Pierre Ferragu downgraded Nvidia shares from “buy” to “neutral” in an industry report he called a “health check” on artificial intelligence stocks.

Ferragu believes that a significant upside will only happen if the outlook beyond 2025 improves substantially, a scenario he isn’t convinced will occur. He notes that projections suggest 35% revenue growth in 2025 from graphics processing units.

He remains bullish on other AI stocks he covers, especially Advanced Micro Devices.

Ferragu values AMD’s stock based on a 35x multiple of his $10 estimate for 2027 earnings per share, translating to a $345 target price for 2026 and a 12-month target of $235, 36% above current levels.

AMD stock is a top pick to carry into 2025

Piper Sandler analysts have named AMD their top large-cap pick for the second half of 2024, citing positive feedback from recent discussions with the chipmaker’s management in Europe.

The investment bank was impressed with AMD’s strategy and competitive positioning, especially regarding the MI300 accelerator series, which they expect to exceed $4 billion in revenue this year.

Beyond AI chips, the firm anticipates positive developments in AMD’s server and PC businesses.

Lastly, Piper Sandler pointed out that AMD’s GPU supply is expected to improve to meet high demand and highlighted that the company’s valuation looks attractive compared to its peers in the computing space.

The rapidly expanding AI market, whose demand will greatly outpace the supply of giants like Nvidia, will allow players like AMD to step in and capture a sizeable market share, especially if they resolve the current bottlenecks plaguing the industry.

All information on our website is for general reference only, investors need to consider and take responsibility for all their investment actions. Info Finance is not responsible for any actions of investors.