Share

Homepage

News

ASML’s Tariff Concerns – Is the Semiconductor Outlook for 2025 at Risk?

ASML’s Tariff Concerns – Is the Semiconductor Outlook for 2025 at Risk?

16 tháng 4 2025

ASML Warns: Tariffs Cast Shadow Over 2025–2026 Financial Outlook

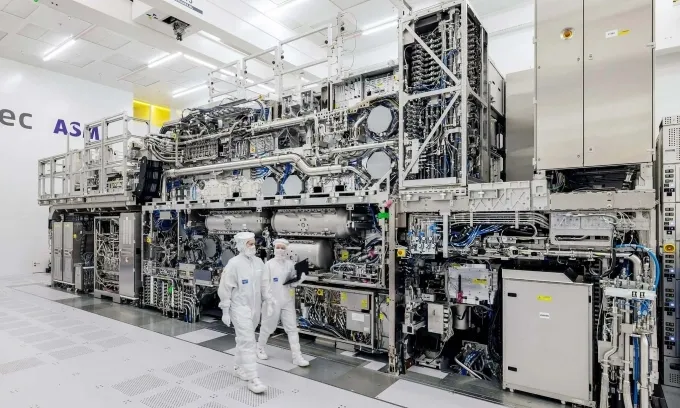

An ASML lithography machine. Photo: ASML

1. Overview of ASML – A Semiconductor Powerhouse

ASML, based in the Netherlands, is a global leader in advanced semiconductor manufacturing equipment, specializing in lithography systems. As the exclusive supplier of EUV (Extreme Ultraviolet) lithography machines, ASML plays a crucial role in chip production for major players like TSMC, Intel, Nvidia, and Samsung.

2. Tariff Concerns Dim ASML’s Market Outlook for 2025–2026

On April 16, 2025, ASML warned that global tariff policies are adding uncertainty to its business outlook for the next two years. Although the company reaffirmed its full-year revenue guidance, market sentiment turned sharply negative, with ASML stock plunging 7% in early trading.

Key updates:

- Q1 bookings fell short at €3.9 billion.

- Q2 revenue guidance: €7.2–7.7 billion, below analysts' expectations.

- Four main tariff concerns: rising costs for imports, supply chain complexity, and potential retaliation from other countries on exports.

3. Impact on the Chip Sector and Investment Strategy

While short-term trade uncertainty affects ASML’s momentum, long-term growth remains supported by global demand for AI technologies. ASML's cutting-edge EUV and next-gen High-NA EUV systems maintain its competitive edge.

Investors with a long-term view may see the current stock dip as a buying opportunity, with analysts maintaining a positive outlook amid accelerating chip sector evolution.

4. Global Tech Stock Market Reactions

The news rippled through global markets, hitting semiconductor stocks in Europe and the U.S. Companies tied to the supply chain—like TSMC and Nvidia—saw short-term pullbacks, driven by cost and disruption concerns.

5. Looking Ahead

ASML emphasized it is working closely with partners to mitigate risks and adapt its global supply strategy. Flexibility in logistics and geopolitical navigation will be key to its resilience.

Investors should monitor upcoming trade policy developments from the U.S., EU, and China, as they directly affect cost structures and global competitiveness in the chip industry.

Infofinance.com

All information on our website is for general reference only, investors need to consider and take responsibility for all their investment actions. Info Finance is not responsible for any actions of investors.