Share

Homepage

News

Chinese Stocks Rally After Data, Gold Hits Record: Markets Wrap

Chinese Stocks Rally After Data, Gold Hits Record: Markets Wrap

01 tháng 4 2024

Chinese shares rose by the most in a month on fresh signs of an economic recovery, forming a bright spot in Asia. Gold hit a record.

Benchmarks gained in China and South Korea, while Japanese equities fell after a report showed confidence among the country’s large manufacturers weakened slightly for the first time in four quarters. US futures edged higher in Asia, with markets in Australia and Hong Kong shut for a holiday.

China’s CSI 300 Index jumped as much as 1.7%, the most since Feb. 29, as a rebound in manufacturing activity reinforced hopes that the nation’s economic recovery may be starting to gain traction.

“Emerging optimism about China is real,” said Vishnu Varathan, chief economist for Asia ex-Japan at Mizuho Bank in Singapore. It may gain traction given “corresponding optimism elsewhere in Asia that dovetails with an upturn in global manufacturing,” he said.

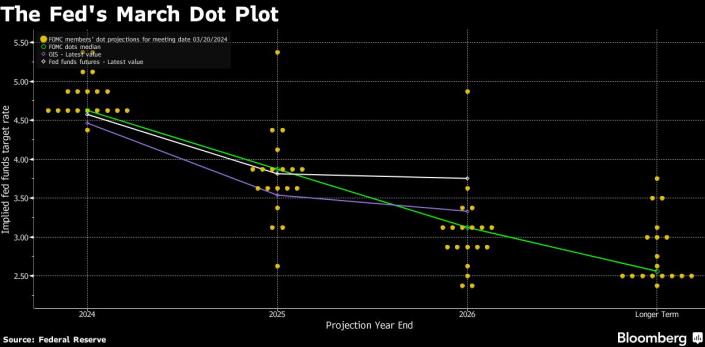

Treasury yields were largely steady in Asia after Federal Reserve Chair Jerome Powell said Friday the central bank’s preferred gauge of inflation was “pretty much in line with our expectations.” Powell added that it wouldn’t be appropriate to lower rates until officials are sure inflation is in check. Investors are betting the US central bank will make that first cut in June.

The core personal consumption expenditures price index — which excludes volatile food and energy costs — rose 0.3% in February after climbing in the previous month, marking its biggest back-to-back gain in a year. The measure is up 2.8% from a year earlier, still above the Fed’s 2% target.

The dollar was steady.

“You have a Fed that at the moment is highly data dependent,” said Matthew Luzzetti, chief US economist at Deutsche Bank. “Until we get either confirmation or a different view on what the data are going to be, it’s kind of hard to gauge exactly where we end up from a Fed policy perspective.”

In commodities, iron ore fell to the lowest in 10 months as China’s years-long property crisis continued to pressure prices. Gold extended a rally that’s been driven by the Federal Reserve moving closer to rate cuts and deepening geopolitical tensions.

Elsewhere, Bitcoin was steady after trading above $71,000. The largest digital currency has jumped almost 70% this year amid persistent demand for US exchange-traded funds holding the token.

All information on our website is for general reference only, investors need to consider and take responsibility for all their investment actions. Info Finance is not responsible for any actions of investors.