Share

Homepage

News

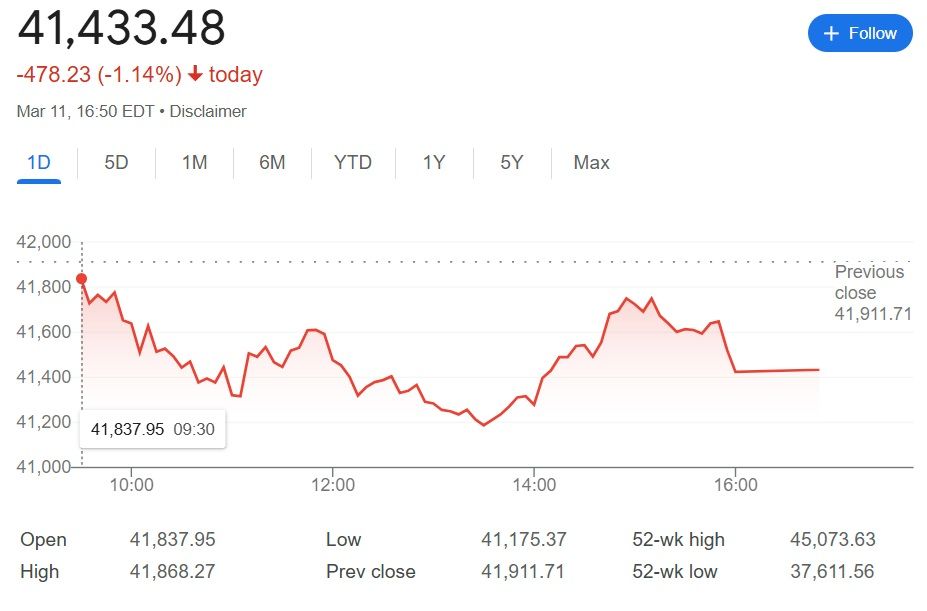

Dow Drops More Than 450 Points, S&P 500 Posts Back-to-Back Loss Over Trump Tariff Uncertainty

Dow Drops More Than 450 Points, S&P 500 Posts Back-to-Back Loss Over Trump Tariff Uncertainty

12 tháng 3 2025

The S&P 500 slid in a head-spinning session for traders as they grappled with new tariffs proposed by President Donald Trump that were in flux throughout most of Tuesday. The trade policy uncertainty has brought the benchmark to the brink of a correction, which is defined as a decline of 10% from its high.

The S&P 500 ended the session 0.76% lower, falling to 5,572.07. At its low of Tuesday’s session, the index was 10% below its record close. The Dow Jones Industrial Average lost 478.23 points, or 1.14%, to close at 41,433.48. The Nasdaq Composite slipped 0.18%, closing at 17,436.10.

Market Turmoil Over Tariff Uncertainty

The S&P 500 was in the green at one point during the trading session before Trump declared on Truth Social that Canadian steel and aluminum duties would double to 50% from 25%, effective Wednesday. The president made the move in response to Ontario Premier Doug Ford’s surcharge on electricity exported to the U.S.

Later in the day, Ford announced he was temporarily suspending the 25% surcharge after discussions with Commerce Secretary Howard Lutnick.

Finally, top Trump trade advisor Peter Navarro stated on CNBC Tuesday afternoon that Trump would not hike the tariffs on Canadian steel and aluminum to 50%. However, the 25% duty that was originally planned would still take effect.

This is the latest in a series of disorderly trade policy moves that have rattled corporate and consumer confidence, weighing on markets over the past three weeks.

Market Sell-Off and Investor Sentiment

On Monday, the Nasdaq experienced its worst day since September 2022, dropping 4%. The 30-stock Dow fell nearly 900 points.

Citigroup this week lowered its rating on U.S. stocks from overweight to neutral, citing a “pause in U.S. exceptionalism” as the primary reason.

“There’s clearly a tolerance for pain on the part of the administration in pursuit of trade goals that are not necessarily entirely economic in nature,” said Ross Mayfield, Baird investment strategist. “At this point, I’m still in the camp that we’re not on the doorstep of a recession, but maybe a slowdown or growth scare. Non-recession sell-offs tend to be shorter and milder than the recessionary ones.”

Recession Fears Mounting

Delta Air Lines added to recession concerns Tuesday as the airline slashed its earnings outlook due to weaker U.S. demand, causing its stock to drop 7.3%. Other travel-related stocks followed suit, with Disney and Airbnb both falling 5%.

Trump Dismisses Market Concerns

Along with haphazard tariff moves, comments from the administration in recent days have stoked investors’ fears about the economy. On Tuesday, Trump appeared unconcerned by the recent market sell-off.

“Markets are going to go up and they’re going to go down but, you know what, we have to rebuild our country,” Trump said when asked about the stock market, according to the White House pool report.

Investors Await CPI Data

Investors are eagerly anticipating the release of February’s Consumer Price Index (CPI) due Wednesday.

“It’ll be really important that we don’t see an upside surprise on CPI because at this point, the Fed does have plenty of dry powder to step in to cut rates and try to boost demand if the economy were to meaningfully slow,” Mayfield added. “But they can only really do that if they feel that inflation expectations and inflation are well anchored.”

With market volatility remaining high, all eyes will be on key economic indicators and further trade developments in the coming days.

Cre: CNBC

All information on our website is for general reference only, investors need to consider and take responsibility for all their investment actions. Info Finance is not responsible for any actions of investors.