Share

Homepage

News

Global Stock Markets Rise Sharply on May 9, 2025: Dow Hits Record, Nikkei Soars, Investment Signals Emerge

Global Stock Markets Rise Sharply on May 9, 2025: Dow Hits Record, Nikkei Soars, Investment Signals Emerge

09 tháng 5 2025

Global stock markets experienced a strong rally on May 9, 2025, with major indices in the U.S., Europe, and Asia recording solid gains. The upbeat sentiment was driven by expectations of resilient corporate earnings, easing inflation pressures, and growing investor confidence.

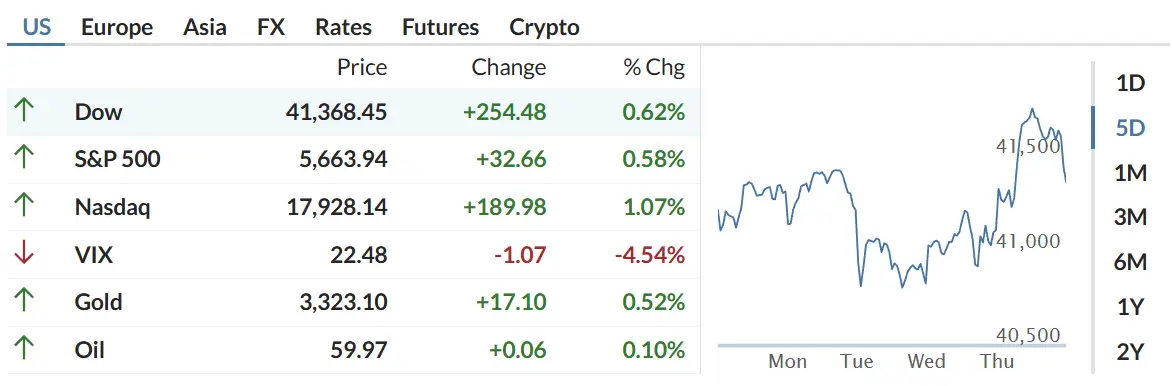

🔹 U.S. Market Highlights

Dow Jones surged by +254.48 points to 41,368.45 (+0.62%), approaching its historical high.

S&P 500 rose by +32.66 points to 5,663.94 (+0.58%).

Nasdaq gained +189.98 points to 17,928.14 (+1.07%), led by technology stocks.

The VIX (volatility index) dropped -1.07 points to 22.48 (-4.54%), signaling easing market concerns.

Gold increased to 3,323.10, up +0.52%.

Oil slightly edged up to $59.97 (+0.10%).

U.S. markets are buoyed by a stronger-than-expected earnings season and optimism about the Fed pausing interest rate hikes.

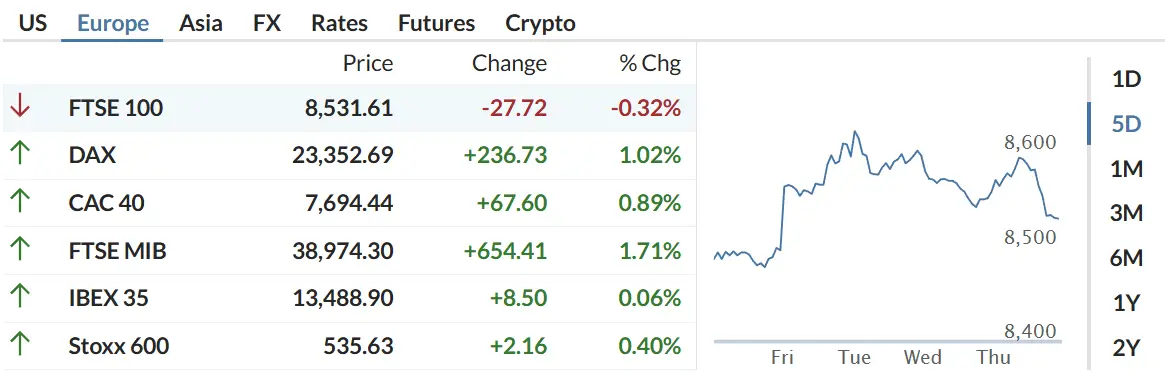

🔹 European Markets

DAX (Germany) climbed +1.02%, reaching 23,352.69.

CAC 40 (France) rose +0.89% to 7,694.44.

FTSE MIB (Italy) saw the strongest gain at +1.71%.

FTSE 100 (UK) was the only major index in the red, down -0.32%.

The broader Stoxx 600 gained +0.40%.

Investor confidence in Europe is supported by improved industrial production data and signs of recovery in consumer spending.

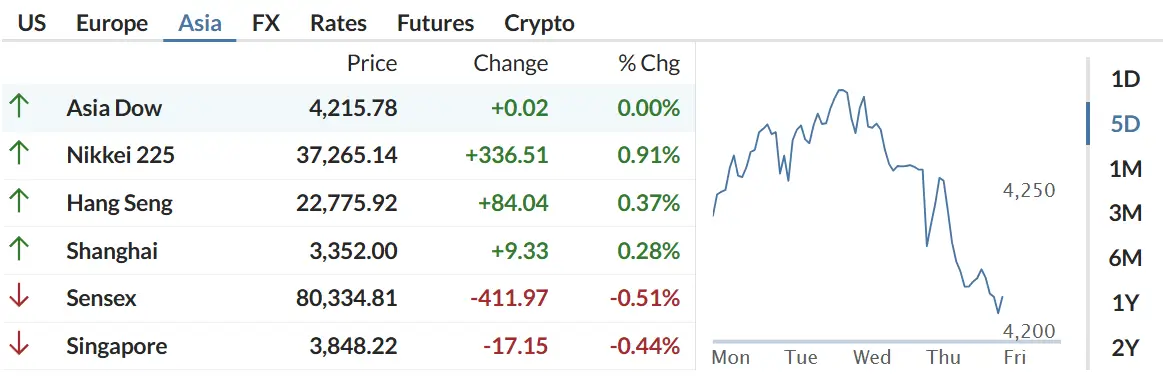

🔹 Asia-Pacific Market Update

Nikkei 225 (Japan) jumped +336.51 points (+0.91%) to 37,265.14, fueled by a weaker yen and strong exports.

Hang Seng (Hong Kong) added +84.04 points (+0.37%).

Shanghai Composite rose slightly by +0.28%.

India's Sensex and Singapore ended the day lower, with losses of -0.51% and -0.44% respectively.

The Japanese stock market is riding high on hopes of increased U.S.–Japan industrial cooperation, especially in shipbuilding and defense-related sectors.

🔍 Investment Outlook: Where to Watch Next?

Based on current trends, here are some investment ideas to consider:

📌 Short-Term Picks:

Gold & Safe-Haven Assets: Remain resilient amid geopolitical uncertainties.

Tech Stocks (U.S. & Japan): Positive earnings and AI momentum continue to drive upside potential.

📌 Medium-Term Opportunities:

Industrial & Shipbuilding (Japan): Likely to benefit from Japan-U.S. strategic cooperation.

Energy Sector: Oil prices are stabilizing, offering selective entry points.

European Industrial Goods: Supported by improving consumer and manufacturing data.

🧭 Conclusion

The global equity market rally on May 9 reflects growing optimism among investors. While risks remain, particularly in Asia’s emerging markets, major developed economies like the U.S., Japan, and parts of Europe offer promising investment opportunities.

Stay tuned to InfoFinance for daily updates and deeper insights into market trends.

All information on our website is for general reference only, investors need to consider and take responsibility for all their investment actions. Info Finance is not responsible for any actions of investors.