Share

Homepage

News

Goldman Sachs says this audio streaming giant is primed to rally nearly 30%

Goldman Sachs says this audio streaming giant is primed to rally nearly 30%

25 tháng 7 2024

Traders work on the floor at the New York Stock Exchange.

Goldman Sachs is turning bullish on Spotify after its solid earnings report this week.

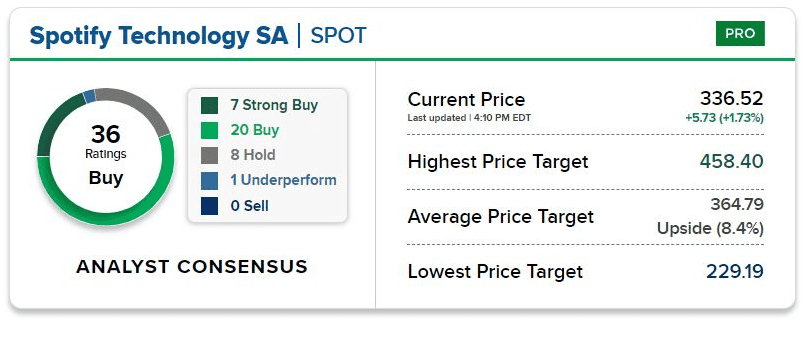

Analyst Eric Sheridan upgraded the streaming stock to buy from neutral and raised his 12-month price target by $105 to $425, suggesting nearly 29% potential upside.

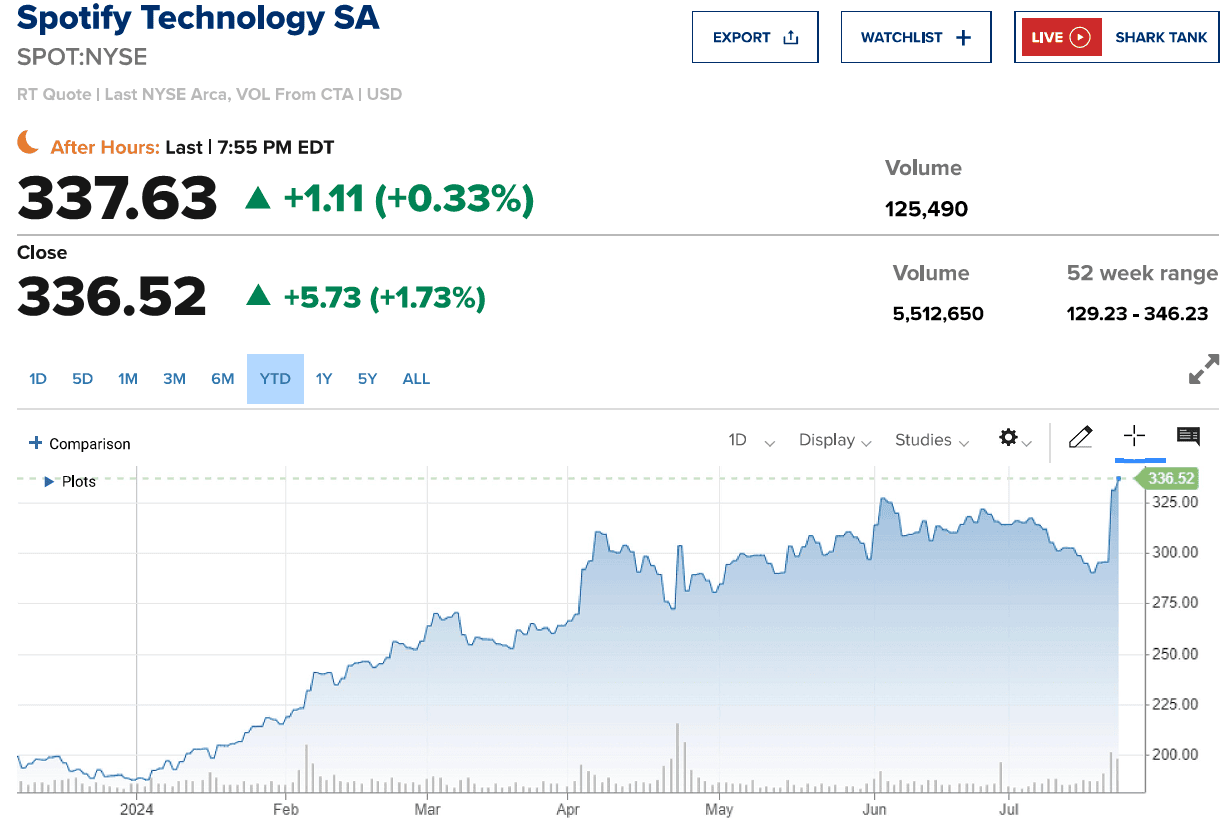

SPOT stock price

“Over the long-term, we see SPOT as having already proven out its industry leading position in terms of the audio distribution landscape (especially when examined against its global scale),” Sheridan said, calling the stock the “clear global audio platform leader.”

Spotify reported record quarterly earnings on Tuesday that sent shares up nearly 12%, marking the stock’s biggest one-day gain since January 2023. Profits rose 45% from a year earlier, and were slightly higher than analysts’ expectations.

Sheridan’s investment thesis relies on a few key factors, including his view that Spotify is achieving strong operating margins in the wake of its restructuring efforts in 2023 and is building free cash flow momentum. He expects Spotify’s gross and operating margins will meet, or even surpass, its medium-term targets. In the second quarter, Spotify’s gross profit margin grew to 29.2% from 27.6% in the prior period.

Spotify should benefit from “scaled compound user growth” that is likely to increase engagement and strengthen its pricing power, he added.

“We can see a scenario that even our newly raised forecasts might still be too conservative on elements of improved advertising revenue margin, ability to translate increased pricing into more profits & operating the company in a more efficient manner on a multi-year view,” Sheridan wrote in the Tuesday note.

Another factor behind Goldman’s upgrade is the potential for Spotify to begin returning cash to shareholders in the form of stock buybacks over the next 12 to 18 months. The analyst said Spotify has “no apparent use” for compounded free cash flow it will generate. He anticipates the upside scenario would be for the company to repurchase as much as roughly 25% of its current market cap through 2029.

Sheridan expects Spotify could also see compounding revenue growth in the mid-teens in the next three to five years.

cnbc

All information on our website is for general reference only, investors need to consider and take responsibility for all their investment actions. Info Finance is not responsible for any actions of investors.