Share

Homepage

News

Is It Too Late to Buy Microsoft Stock?

Is It Too Late to Buy Microsoft Stock?

09 tháng 8 2024

The company has a thoroughly diverse business that delivers consistent long-term growth.

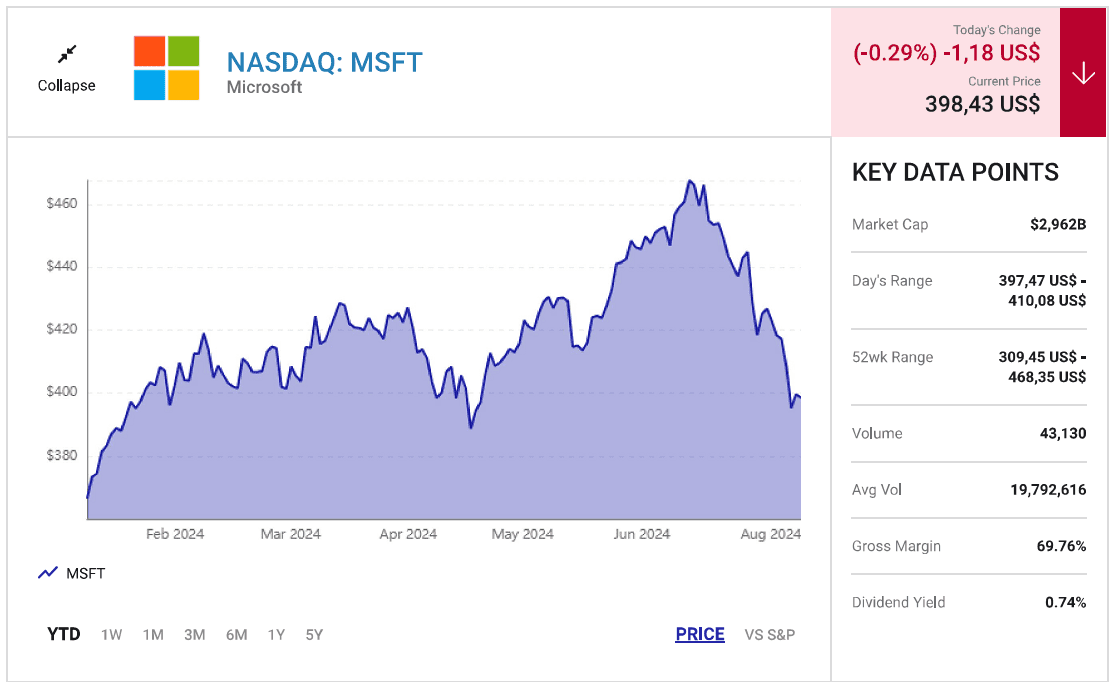

Microsoft's (MSFT -0.29%) stock is down more than 11% over the last month, brought down by multiple factors. A tech sell-off kicked off in July, fueled by concerns in the chip market and the beginning of earnings season. Then, Microsoft's stock was brought down further when the company released its fourth quarter of 2024 results.

The period beat expectations on several fronts, including revenue and earnings per share. However, a miss in its cloud division saw Microsoft's stock price tumble 7% in after-hours trading on July 30, as Wall Street grew wary of the company's prospects in artificial intelligence (AI).

Yet recent stock market fluctuations only highlight the importance of investing with a long-term mindset. Despite a dip, Microsoft remains a tech behemoth that has seen its share price rise 853% over the last decade. The company holds leading positions in multiple high-growth sectors, including productivity software, cloud computing, gaming, digital advertising, and AI.

Microsoft's prominence in tech and a recent dip might have some investors concerned that its stock has hit its ceiling and it's too late for new investors to see significant gains. However, tech is an ever-expanding industry that is moved forward by companies like Microsoft that consistently reinvest in their businesses.

So, here's why Microsoft remains a compelling buy this year.

Positive quarterly results despite a miss in cloud earnings

Microsoft's Q4 2024 revenue rose 15% year over year to $65 billion, beating analysts' forecasts by $260 million. Earnings per share of $2.95 also outperformed Wall Street estimates by $0.02. Growth was primarily thanks to double-digit revenue jumps in its three main segments.

However, the earnings beat was overshadowed by a miss in Microsoft's intelligent cloud segment, which posted revenue of $28.52 billion compared to expectations of $28.69. Despite the miss, the segment still reported year-over-year sales gains of 19%. Meanwhile, revenue from Azure and other cloud services soared 29%.

Microsoft's cloud performance largely represents its position in AI as its platform, Azure, offers a range of generative features. Considering the hype surrounding AI since the start of last year, Microsoft's slight miss sent Wall Street into a panic. However, the company maintains significant potential in the industry.

Rising cloud competition from Amazon Web Services (AWS) and Alphabet's Google Cloud means cloud growth will likely be gradual for Microsoft. However, the company's dominance in tech and diverse business model grants it multiple ways to expand in AI.

The second quarter of 2024 saw revenue in Microsoft's productivity and business processes segment increase by 11% year over year, alongside a 13% rise in Office Commercial products. The growth comes after the company introduced several new AI tools to its Office productivity suite, including Copilot, an AI assistant that boosts efficiency with language generation tools and is a $30 monthly add-on to a Microsoft 365 subscription.

In addition to cloud computing and productivity services, Microsoft has a consistently expanding personal computing business that posted sales growth of 14% year over year in the company's latest quarter. The segment allows another avenue for AI growth in the coming years as Microsoft's technology improves and AI PCs become a larger part of the PC market.

Microsoft is home to a thoroughly diverse business, which allows it to give areas like cloud computing time to flourish in AI. Outperforming estimates in Q4 2024 illustrate the reliability of Microsoft's business and leading role in tech.

A recent sell-off has increased the value of Microsoft's stock

Microsoft's stock has risen 21% in the last 12 months, outperforming the S&P 500's 17% rise. Meanwhile, its free cash flow has steadily climbed 17% to $74 billion, indicating that Microsoft is well equipped to continue investing in its business and keep up with its rivals.

The Windows company is on a promising growth path, with a recent dip in its share price only strengthening the bullish argument for its stock.

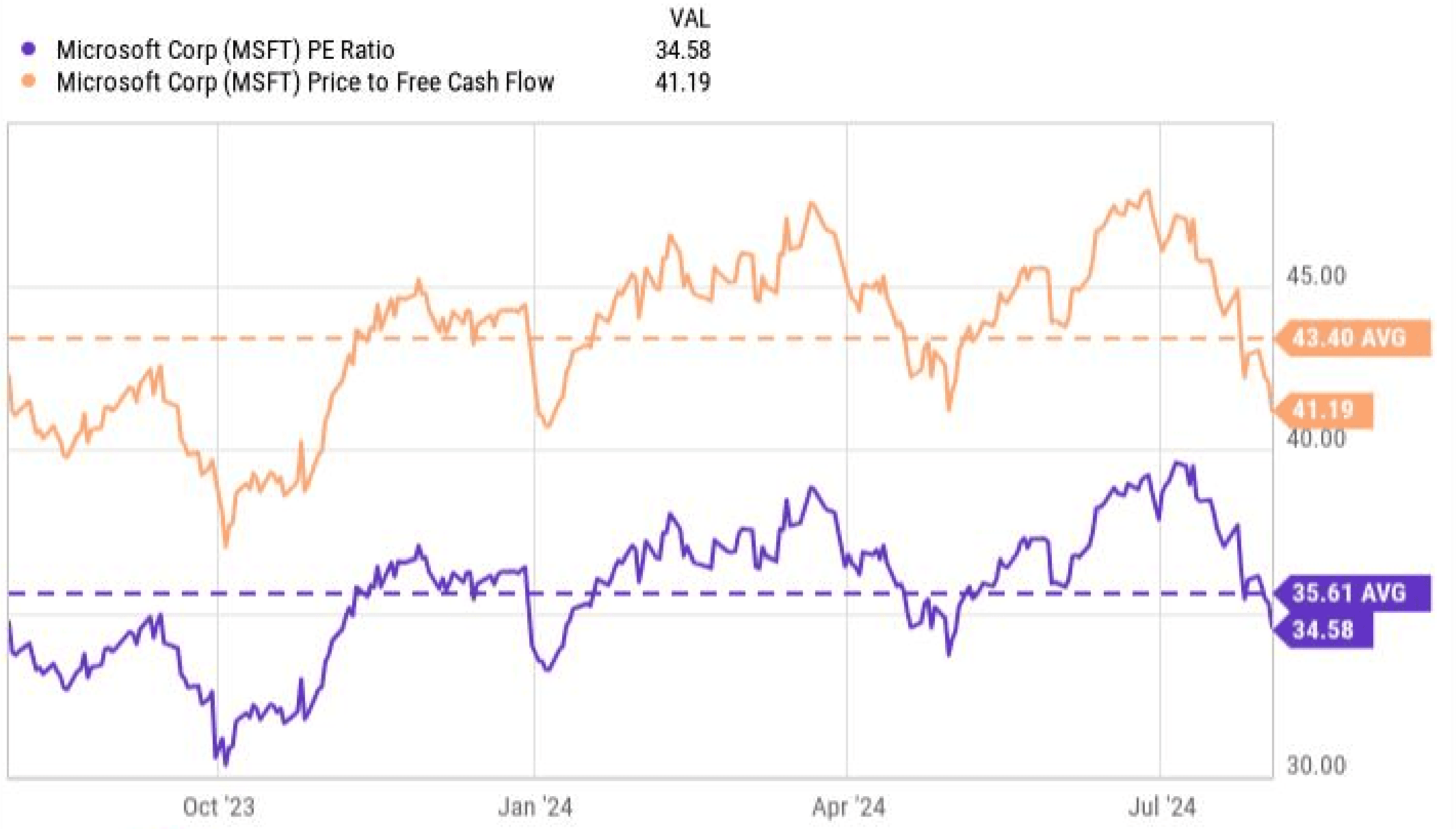

Data by YCharts

Along with a tumbling share price, Microsoft's price-to-earnings (P/E) ratio and price-to-sales (P/S) have also decreased by 11%, representing a boost in its stock's value. The data in the table above shows Microsoft's P/E and P/S currently sit at 35 and 41.

These figures don't illustrate a significant bargain on their own. However, they are below Microsoft's 12-month averages for both metrics, indicating that its stock is a better value than it has been for most of the last year.

In addition to its diversified business model, potent role in tech, and vast cash reserves, Microsoft remains an attractive long-term investment. Its solid outlook suggests it is not too late to still enjoy major gains from this tech giant in the coming years.

fool

All information on our website is for general reference only, investors need to consider and take responsibility for all their investment actions. Info Finance is not responsible for any actions of investors.