Share

Homepage

News

Nvidia Stock Finds Its Footing. The Chip Maker Faces Friendly Competition.

Nvidia Stock Finds Its Footing. The Chip Maker Faces Friendly Competition.

10 tháng 4 2024

Nvidia stock was bouncing back early Wednesday morning after sliding into correction territory. Increasingly complex relationships with customers such as Google are part of the reason for its recent struggles.

Nvidia shares were up 2% at $870.20. The stock reversed earlier losses of more than 2% after the latest U.S. inflation data came in hotter than expected. Nvidia shares closed down more than 10% on Tuesday from their record closing high of $950.02 reached in late March.

Recent worries have focused on competition from some of Nvidia’s biggest customers, who use its hardware to power artificial intelligence technology.

The issue was neatly shown by news from Alphabet’s Google at a technology conference this week. The search-engine company made a series of announcements about in-house chips, including noting that the most powerful version of its TPU processors for AI training and inference applications, known as TPU v5p, has become generally available via Google Cloud.

That indicates tougher competition for Nvidia’s graphics-processing units. Google trained its own Gemini AI model on TPU processors, in contrast to peers such as Meta Platforms which has said it is using Nvidia chips to train its next-generation AI model.

At the same time, Google said that it would make Nvidia’s new Blackwell range of chips available to its Cloud customers early next year, as well as expanding access to technology powered by Nvidia’s H100 processors.

Google doesn’t appear to be keen on positioning itself as a direct rival to Nvidia. In a blog post on Tuesday, Google stressed how its customers were “leveraging both Google Cloud TPU and GPU-based services.” However, even relatively friendly competition could pressure Nvidia and the margin it can make on its chips compared with the initial rush for its hardware amid the AI boom.

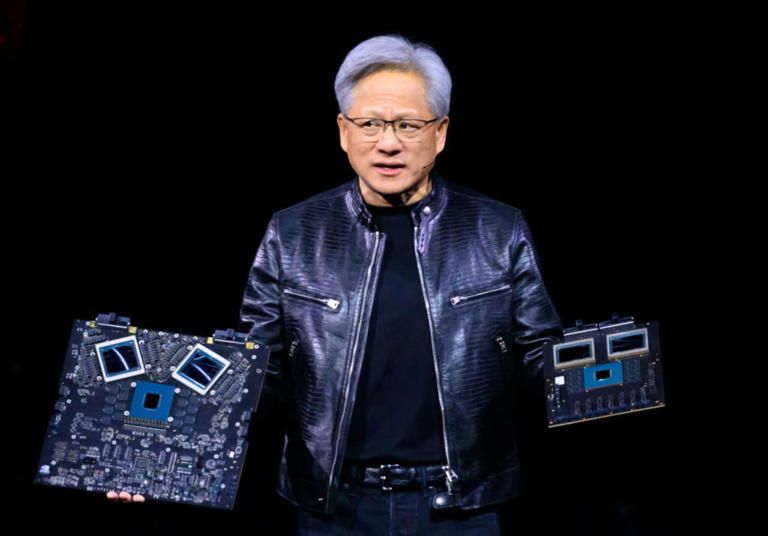

Nvidia CEO Jensen Huang has responded to concerns about competition by emphasizing the company’s advantage in total cost of ownership, or the cost when taking into account indirect factors such as power and cooling demands. Morgan Stanley analyst Joseph Moore pointed to that argument in a research note on Wednesday backing the stock.

“Faced with limited slots for AI processors, we are seeing some of the appetite for alternatives taking a back seat to the highest ROI [return on investment] processor, which continues to be Nvidia,” Moore said.

Moore raised his target price on Nvidia stock to $1,000 from $795 and kept an Overweight rating on the stock.

Other chip makers were down on Wednesday. Advanced Micro Devices was off by 1.8%, and Intel was down by 1.9%. The losses accelerated after the release of March’s CPI data.

Despite their recent losing spell, Nvidia shares have gained 72% this year through Tuesday’s close. That compares with a 9.2% rise in the S&P 500 index and a 8.6% rise in the Nasdaq Composite over the same period.

All information on our website is for general reference only, investors need to consider and take responsibility for all their investment actions. Info Finance is not responsible for any actions of investors.