Share

Homepage

News

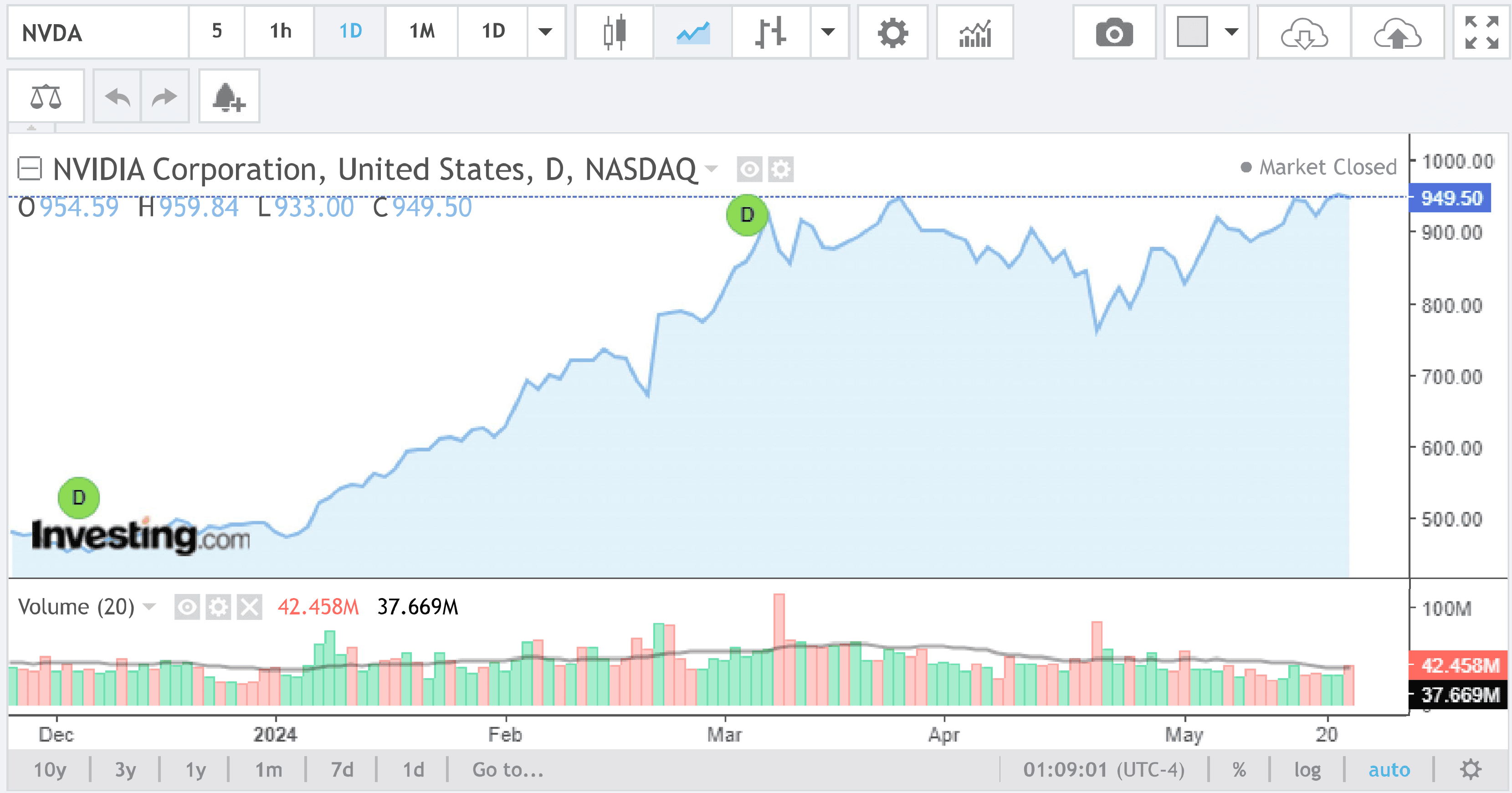

Nvidia Stock Rises as Earnings Beat High Expectations

Nvidia Stock Rises as Earnings Beat High Expectations

23 tháng 5 2024

Nvidia (NVDA) fulfilled the world’s high expectations with its April quarter results. The hurdle was high, given that many now consider it the most important stock in the world.

“The next industrial revolution has begun,” CEO Jensen Huang said in the Wednesday earnings release. “Companies and countries are partnering with Nvidia to shift the trillion-dollar traditional data centers to accelerated computing and build a new type of data center—AI factories—to produce a new commodity: artificial intelligence.”

Sales jumped 262% in the first fiscal quarter, to $26 billion. It’s an 18% gain from the previous quarter.

Earnings were $6.12 a share (ignoring noncash costs), up 461% from a year ago and 19% from the prior quarter. They were $5.98 a share under generally accepted accounting principles.

Both figures easily beat Wall Street’s estimates. Analysts had forecast $24.6 billion in sales and earnings of $5.60 a share.

Guidance for the July quarter is for revenue of $28 billion. That also exceeds the average Wall Street forecast for $26.6 billion.

Nvidia chips are now the undisputed essential for artificial intelligence platforms. The company’s sales to cloud-computing data centers rose more than fivefold, to $22.6 billion, or some 87% of total revenue.

Large cloud providers continued to drive strong growth, said Chief Financial Officer Colette Kress. Their demand accounted for around 45% of all data center revenue in the quarter.

The company’s current accelerator architecture, Hopper, accounted for most of the quarter’s sales. Supply constraints still limit supplies of the most advanced Hopper products, said Kress. Demand for Nvidia chips will exceed supply well into 2025, she said.

Nvidia’s AI architecture has doubled in processing power every six months. The newest accelerator design—Blackwell, unveiled in March by Huang —can buzz through AI’s hardest training sets four times faster than Nvidia’s Hopper chips.

So Nvidia’s business is scaling in line with its chips’ power.

The stock was up 5% in after-hours trading following the report, to a record $1,001. In their blastoff this year, Nvidia shares had approached $1,000 but never before crossed that threshold.

Along with the quarter’s earnings, Nvidia announced it would split its stock 10-for-1 on June 10.

The split obliged Nvidia to raise its quarterly dividend from four cents a share to 10 cents—so that it would be at least one cent after the split.

On the earnings conference call, Morgan Stanley analyst Joe Moore asked if the transition to Blackwell might slow demand for Hopper.

There is too much pent-up AI demand for that to happen, said Huang. “We will see increasing demand for Hopper this quarter,” he said. “Demand will outstrip supply for the foreseeable future.”

Production has begun on Blackwell, said the CEO. Data center customers should be up and running with the new architecture in Nvidia’s fiscal quarter ending January 2025.

“We will see a lot of Blackwell revenue this year,” Huang said.

And after Blackwell, there will be another chip. The company introduces a new accelerator every year, said Huang, but it is also innovating with new network products that speed AI computing.

Each generation of new hardware will be backward-compatible with solutions a customer has built on earlier products, Huang promised. “It’s just going to get faster and faster and faster,” he said.

If July 2025 sales are close to today’s $28 billion guidance, that will represent a 170% rise from the July 2023 quarter. That’s great, but a smaller jump from the just-reported April quarter’s 260% rise.

Oppenheimer analyst Rick Schafer correctly anticipated that data center sales jumped more than 400% in the April, to nearly 90% of sales. Microsoft MSFT 0.34% and Facebook-parent Meta Platforms META 0.68% were big buyers in 2023. Amazon.com AMZN -0.01% has been buying big this year.

Competition in AI infrastructure is furious among Microsoft, Amazon, the Google unit of Alphabet GOOGL -0.83%, Oracle, and others.

Even if Nvidia’s climb becomes a little less steep for the next few quarters, its lead over AI acceleration rivals looks secure.

“There is no match to Nvidia’s products offering this year and next,” wrote Baird analyst Tristan Gerra in a Monday note, raising his target price from $1,050 to $1,200.

barrons

All information on our website is for general reference only, investors need to consider and take responsibility for all their investment actions. Info Finance is not responsible for any actions of investors.