Share

Homepage

News

Revolut IPO: Everything you need to know

Revolut IPO: Everything you need to know

26 tháng 2 2024

Revolut’s IPO has been in the talks for a while now. The current market environment might not be the best, but the company reporting its first annual profit eight years after being founded might accelerate things. Revolut is also getting closer to being granted a UK banking license, which would be a big step forward for the fintech company.

Revolut CEO Storonsky previously said that he wants the company to generate a few billion dollars a year before he takes it public. The challenging macroeconomic conditions are creating headwinds, but an IPO in late 2023 shouldn´t be written off entirely just yet.

How does Revolut make money?

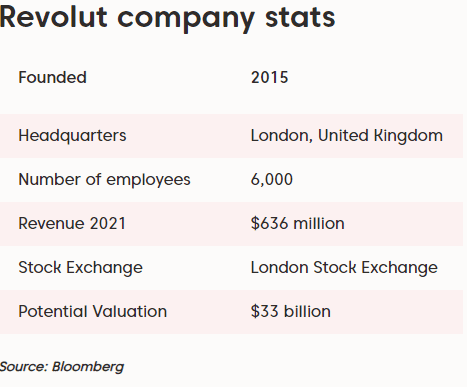

Revolut was founded in London in 2015 by Nikolay Storonsky and Vlad Yatsenko and still maintains its headquarters there. The company offers a variety of financial services primarily aimed at retail customers and smaller companies - ranging from multi-currency bank accounts to debit cards, currency exchange, stock trading, and cryptocurrency investing.

Revolut´s revenues come from interchange fees, interest, and fees from its services, such as the fees for its premium products.

Interchange revenues are generated from the transaction fee that Revolut imposes on its users. Revenues generated from interest are on the rise now that interest rates are increasing. At the same time, Revolut offers a variety of packages for its premium products, such as Revolut Plus, Revolut Premium, and Revolut Metal.

With Europe getting saturated with neobanks, Revolut is already working hard to expand into the United States, as well as Brazil, Mexico, and India. The firm recently announced it has surpassed 25 million users worldwide.

If Revolut is granted a UK banking license, it could help accelerate its lending activity and boost incomes made from this revenue source.

The IPO: When, where and what to expect

Revolut’s last valuation was done in 2021 when the fintech firm raised $800 million in a funding round led by SoftBank and Tiger Global. This represented a massive increase from 2020 when Revolut was valued at only $5.5 billion.

While there is no date yet for the Revolut IPO, a listing on the London Stock Exchange (LSE) seems most likely, as the company has its headquarters in the UK, which is also its most important market.

The recent 33 billion valuation makes Revolut the UK´s biggest fintech company and can even put some of the well-established names in the financial industry to shame.

The company recently announced revenues of 636 million GBP for 2021 and a pre-tax profit of 59.1 million GBP. This was a milestone for Revolut as it turned a profit for the first time in 8 years, and makes an IPO more feasible.

That being said, the company might prefer to wait until it has cleared another major hurdle - getting a UK banking license - before it goes public.

3 steps to trade Revolut IPO with Axi

An Initial Public Offering (IPO) is an investor’s first chance to gain exposure to an organisation. An IPO is an important milestone for a company looking to raise capital and an opportunity for investors to get involved in a hopefully growing business.

With Axi you can get exposure to Revolut's IPO as soon as it’s listed on a specific exchange and prices from the exchange become available to our liquidity providers.

All information on our website is for general reference only, investors need to consider and take responsibility for all their investment actions. Info Finance is not responsible for any actions of investors.