Share

Homepage

News

The Fed may implement deeper-than-expected interest rate cuts amid rising unemployment.

The Fed may implement deeper-than-expected interest rate cuts amid rising unemployment.

03 tháng 9 2024

Amid rising unemployment, the U.S. Federal Reserve (Fed) may implement deeper interest rate cuts than the market anticipates. According to Robert Sockin, a senior economist at Citi, the Fed is likely to carry out rate cuts totaling 125 basis points by the end of this year.

In an interview with Yahoo Finance, Sockin stated that Citi forecasts the Fed will execute three rate cuts in 2024. Specifically, the Fed is expected to start with a 50 basis point cut, followed by another 50 basis points at the next meeting, and a final 25 basis points in December. This would bring the total cuts to 125 basis points.

Citi's prediction is based on the cooling labor market, where unemployment is on the rise. Sockin expressed concern that the increasing unemployment rate is an alarming sign, which might prompt the Fed to take more aggressive action on rate cuts, especially if the central bank perceives economic growth slowing faster than anticipated.

In July, the unemployment rate unexpectedly rose from 4.1% in June to 4.3%. Although jobless claims have slightly decreased in recent weeks, they remain relatively high. Last week, jobless claims fell to 231,000, down from this year’s peak of 250,000 at the end of July, according to data from the U.S. Department of Labor.

Sockin emphasized that if unemployment data continues to show a less optimistic trend, the Fed may opt for even more significant rate cuts. He also noted that the Fed's decision will hinge on upcoming employment data. Should the unemployment rate continue to climb, the likelihood of the Fed taking more decisive action increases.

Currently, according to the CME’s FedWatch tool, the market is pricing in a 25 basis point rate cut in September, although a 50 basis point cut by the Fed remains on the table.

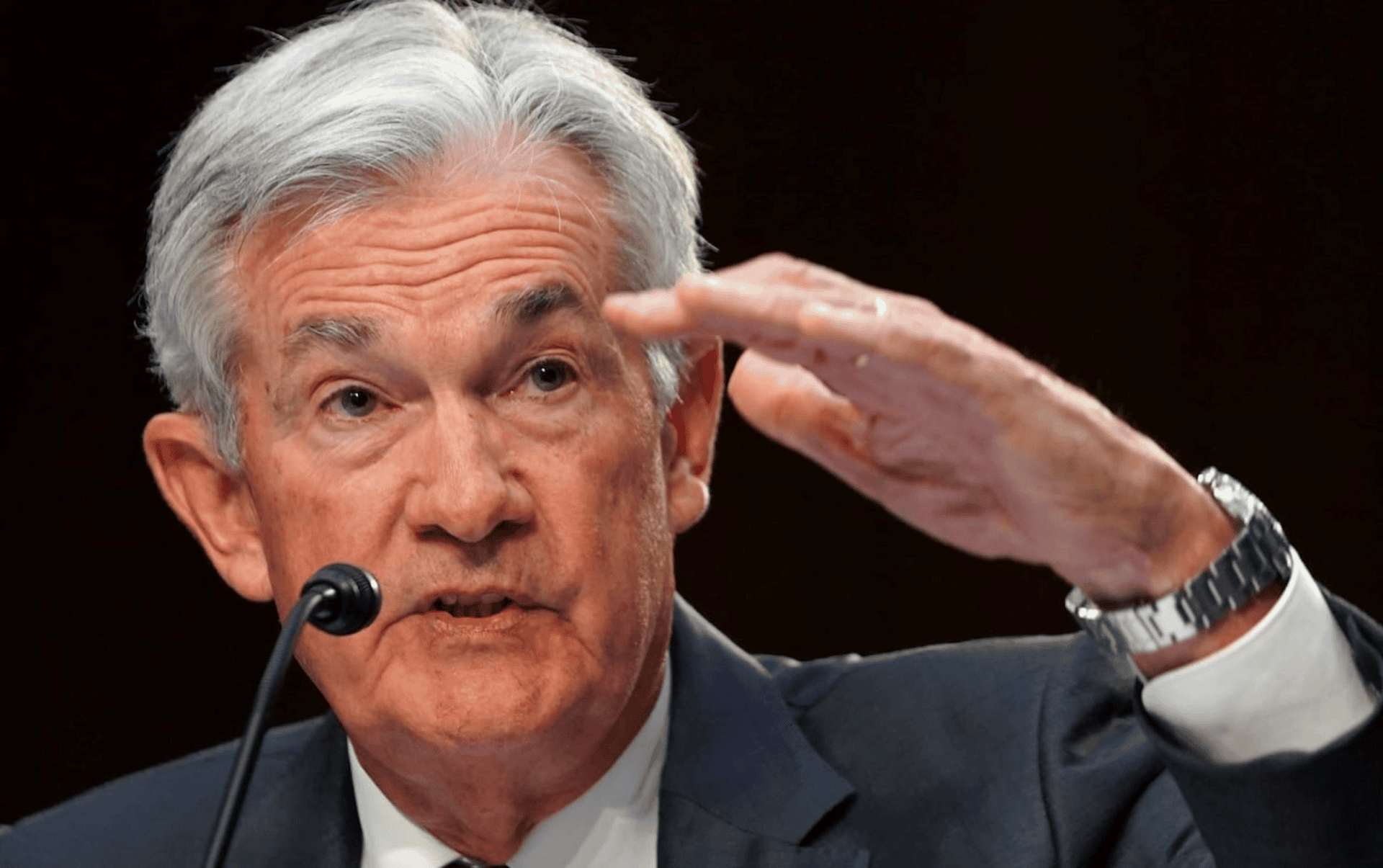

At the Jackson Hole symposium last week, Fed Chair Jerome Powell confirmed that the Fed is ready to lower interest rates in September. Powell emphasized, 'It is time for policy to be adjusted. The path is clear, but the timing and pace of cuts will depend on upcoming data, changes in outlook, and balancing risks.'

Powell also reiterated that the Fed remains committed to its dual mandate of bringing inflation down to 2% and promoting a healthy labor market while seeking to ease monetary policy as necessary.

All information on our website is for general reference only, investors need to consider and take responsibility for all their investment actions. Info Finance is not responsible for any actions of investors.