Share

Homepage

News

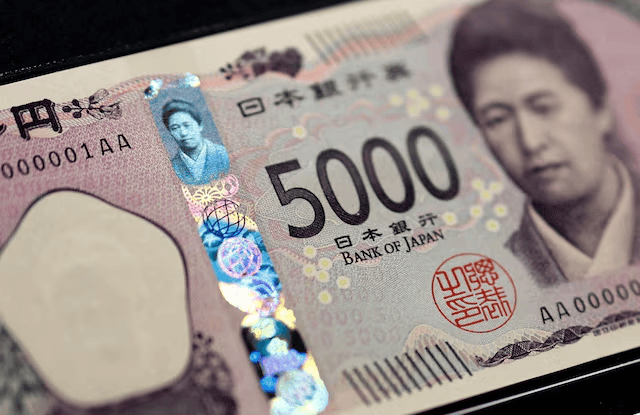

USD Weakens Against Japanese Yen and Major Currencies

USD Weakens Against Japanese Yen and Major Currencies

26 tháng 8 2024

On Monday, the global currency market experienced significant fluctuations as the USD weakened against the Japanese Yen’s strong appreciation. This shift followed a statement by Fed Chairman Jerome Powell, declaring that "it's time to adjust policy," in stark contrast to the steadfast stance of Bank of Japan (BoJ) Governor Kazuo Ueda.

In the early hours of August 26, the USD dropped 0.59% to 143.56 Yen, the lowest level since August 5. This move indicates that investors are adjusting their positions following Jerome Powell's speech at the Jackson Hole conference. Powell employed stronger language, avoiding more cautious terms like "gradual/slow," which sparked market excitement. Tapas Strickland, Head of Market Economics at National Australia Bank, noted that Powell's shift in tone might have altered investor expectations.

In contrast, Bank of Japan (BoJ) Governor Kazuo Ueda maintained a cautious stance. In his speech to Parliament on the morning of August 23, Ueda reaffirmed the commitment to "stick to the scenario of adjusting the degree of easing" and to "mitigate the impact of the July rate hike on the market." This caught many by surprise, particularly as Yen carry trades and Japanese stock sell-offs increased following the unexpected rate hike.

Not only the Japanese Yen but other major currencies also recovered against the USD. The Euro is trading at 1.1190 USD, near its 13-month high of 1.1201 USD set on August 23. The British Pound is hovering at 1.3215 USD after hitting a 17-month high of 1.32295 USD.

The market is now confident that the Fed will begin its rate-cutting cycle on September 18. The current question is the extent of the cut, with a 36.5% chance that the Fed will implement a substantial 50 basis point cut, up from 25% a week earlier, according to CME Group's FedWatch tool.

In the cryptocurrency market, Bitcoin also saw gains, rising 0.9% to 64,271 USD, reflecting investor optimism towards risk assets amid potential monetary easing by the Fed.

All information on our website is for general reference only, investors need to consider and take responsibility for all their investment actions. Info Finance is not responsible for any actions of investors.