Share

Homepage

News

Wall Street experts nearly unanimous on gold posting gains next week, Main Street sentiment firmly bullish

Wall Street experts nearly unanimous on gold posting gains next week, Main Street sentiment firmly bullish

15 tháng 7 2024

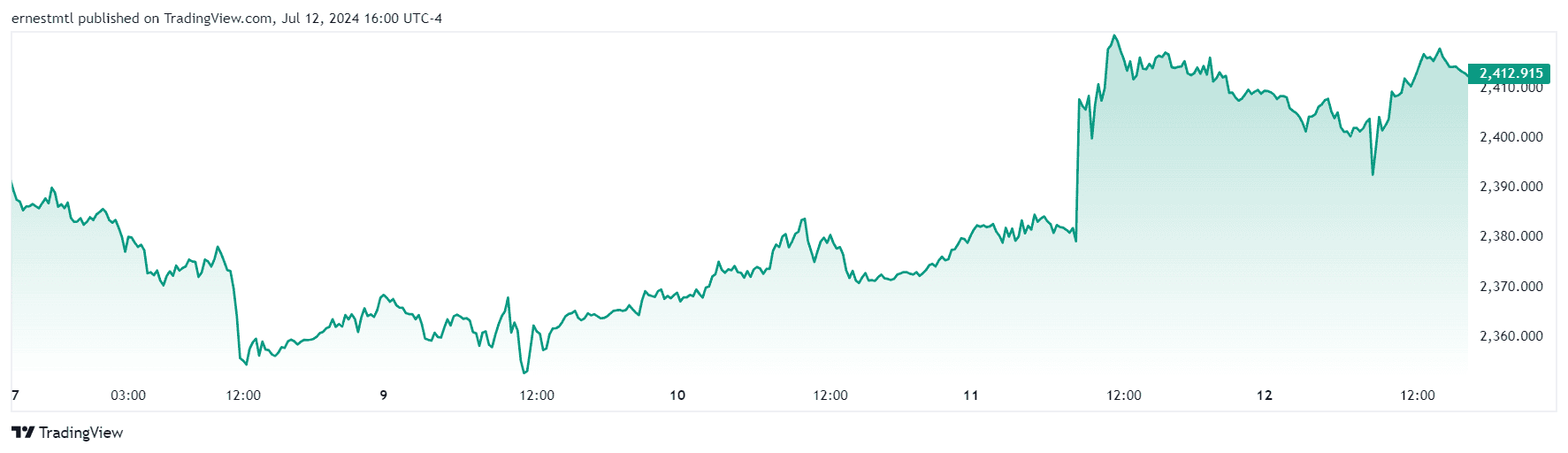

(Kitco News) – Precious metals investors went for another wild ride this week, with gold getting buffeted by positive and negative news, but enjoying a very strong week on balance.

Spot gold kicked off the week trading at $2,391.62 per ounce, and trended steadily downward on Sunday night and into Monday’s North American trading session before news that China central bank had refrained from gold purchases for the second straight month drove the yellow metal from $2,378 per ounce to a low of $2,354.30 shortly after noon EDT.

From there, gold traded in a relatively narrow $15 range for much of the week, testing the low $2350s once more on Tuesday before trending steadily upward through two days of relatively dovish congressional testimony from Federal Reserve Chair Jerome Powell before markets turned their attention to the pair of U.S. inflation reports due later in the week.

When the June CPI report came in significantly better than expectations on Thursday morning, traders responded by driving spot gold from $2,379.12 to $2,407.66 in a matter of minutes, and by 11:15 am, the yellow metal had posted its weekly high above $2,420 per ounce.

The market then turned its focus to Friday morning’s PPI release, and the disappointing headline prints caused only a momentary slide to $2,392.51 before prices rebounded and spot gold once again began climbing above the $2,400 per ounce level, topping out only a couple of dollars short of the Thursday high just before 2:00 p.m. EDT.

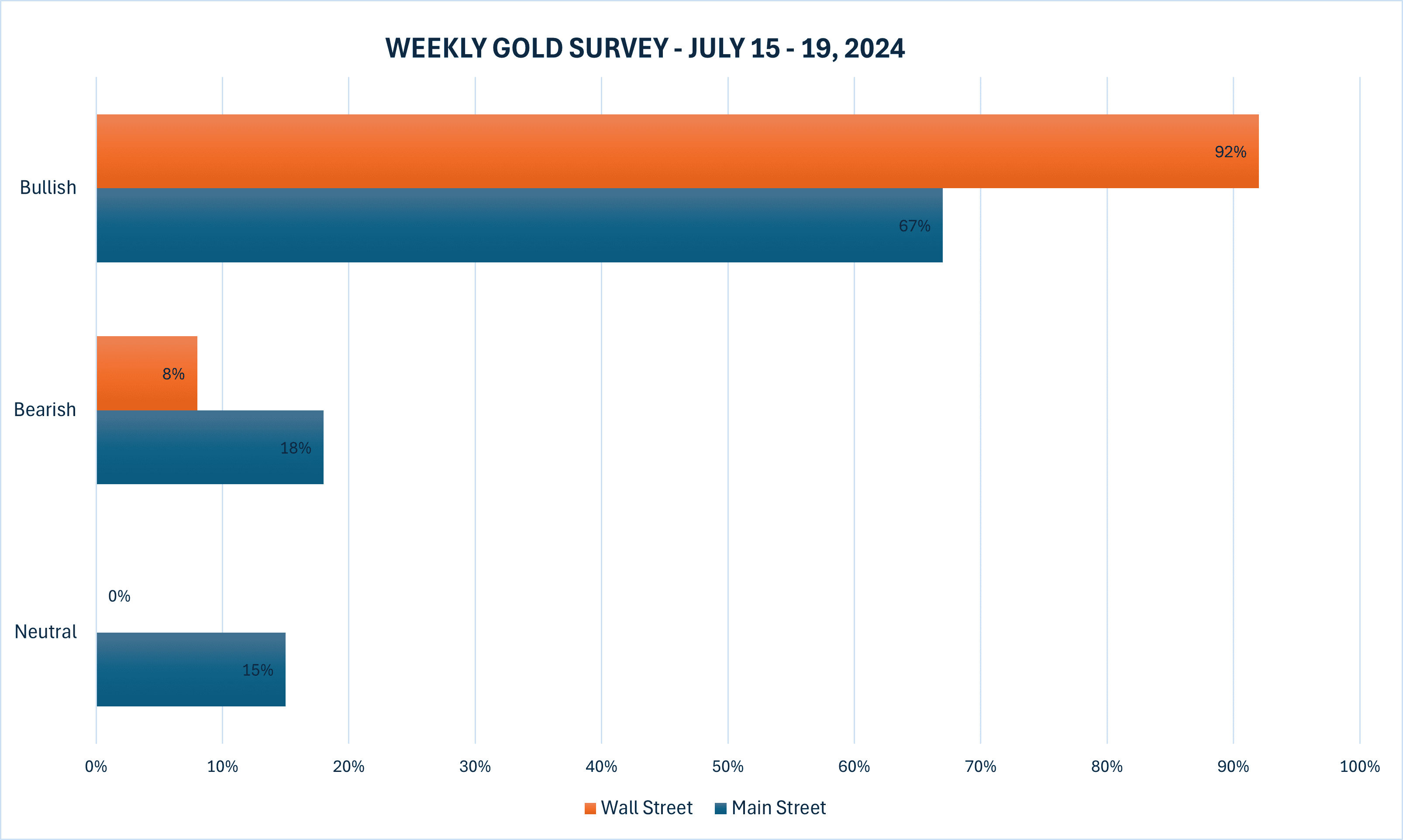

The latest Kitco News Weekly Gold Survey shows industry experts nearly unanimous on gold’s bullish prospects for the coming week, while retail sentiment is also firmly in optimistic territory.

This week, 13 Wall Street analysts participated in the Kitco News Gold Survey, and with but one exception, they all agreed that the yellow metal was set to go higher. 12 experts, or 92%, expect to see gold prices post further gains next week, while just one analyst, representing 8%, predicts a price decline. None saw gold trending sideways in the week ahead.

Meanwhile, 178 votes were cast in Kitco’s online poll, with Main Street investors maintaining their bullish stance from last week. 119 retail traders, or 67%, look for gold prices to rise next week. Another 32, or 18%, expected the yellow metal to trade lower, while 27 respondents, representing the remaining 15%, saw prices trading sideways during the week ahead.

Marc Chandler, Managing Director at Bannockburn Global Forex, said the trend remains upward for the yellow metal.

“Gold rose for the third consecutive week, helped by lower US interest rates and a weaker dollar,” he wrote. “It surged to almost $2425 after the soft CPI reading and elevated speculation that the Fed may cut rates more than twice this year (~40% chance of a third cut). Some near-term consolidation looks likely, but market sentiment is constructive.”

“Separately, we note that although the PBOC may not have bought gold last month, other central banks in Asia and Europe reportedly have, and a survey by UBS (40 central banks) found the biggest concern was geopolitical tensions and the weaponization of reserves.”

“Up,” said James Stanley, senior market strategist at Forex.com. “In my opinion, this is still in bulls’ control and the fact that they held support through Q2, even with multiple bearish formations in play, highlights that control element well. I think $2,500 is still very much doable.”

Adam Button, head of currency strategy at Forexlive.com, acknowledged that two days of testimony from Federal Reserve Chair Jerome Powell was significant, but he expected gold to be driven down by the news from China this week.

“China saying they didn't buy any for the second month in a row, that was going to be the whole week right there,” he said. “Monday, we took a dive. People were expecting China to just take the one month off, but they seem to have taken two.”

With China’s central bank such a significant driver of gold’s price action over the last couple of years, Button was surprised that the precious metal’s dip was so shallow and short-lived.

“Down,” said Darin Newsom, Senior Market Analyst at Barchart.com, who was the lone doubter this week.

Next week, markets will shift their focus from the Federal Reserve to the European Central Bank, which will announce its interest rate decision on Thursday morning. Markets are priced in for a hold from the ECB after the central bank cut its benchmark interest rate in June, but they will also be attentive to signals of potential future cuts.

The most significant North American data release will be U.S. retail sales data for June on Tuesday, with economists warning that further weakness in consumption could add more momentum to market expectations for a September rate cut.

Markets will also be paying attention to the Empire State manufacturing survey and comments from Fed Chair Powell on Monday, U.S. housing starts and building permits on Wednesday, and the Philly Fed survey and weekly jobless claims on Thursday.

kitco

All information on our website is for general reference only, investors need to consider and take responsibility for all their investment actions. Info Finance is not responsible for any actions of investors.