Share

Homepage

News

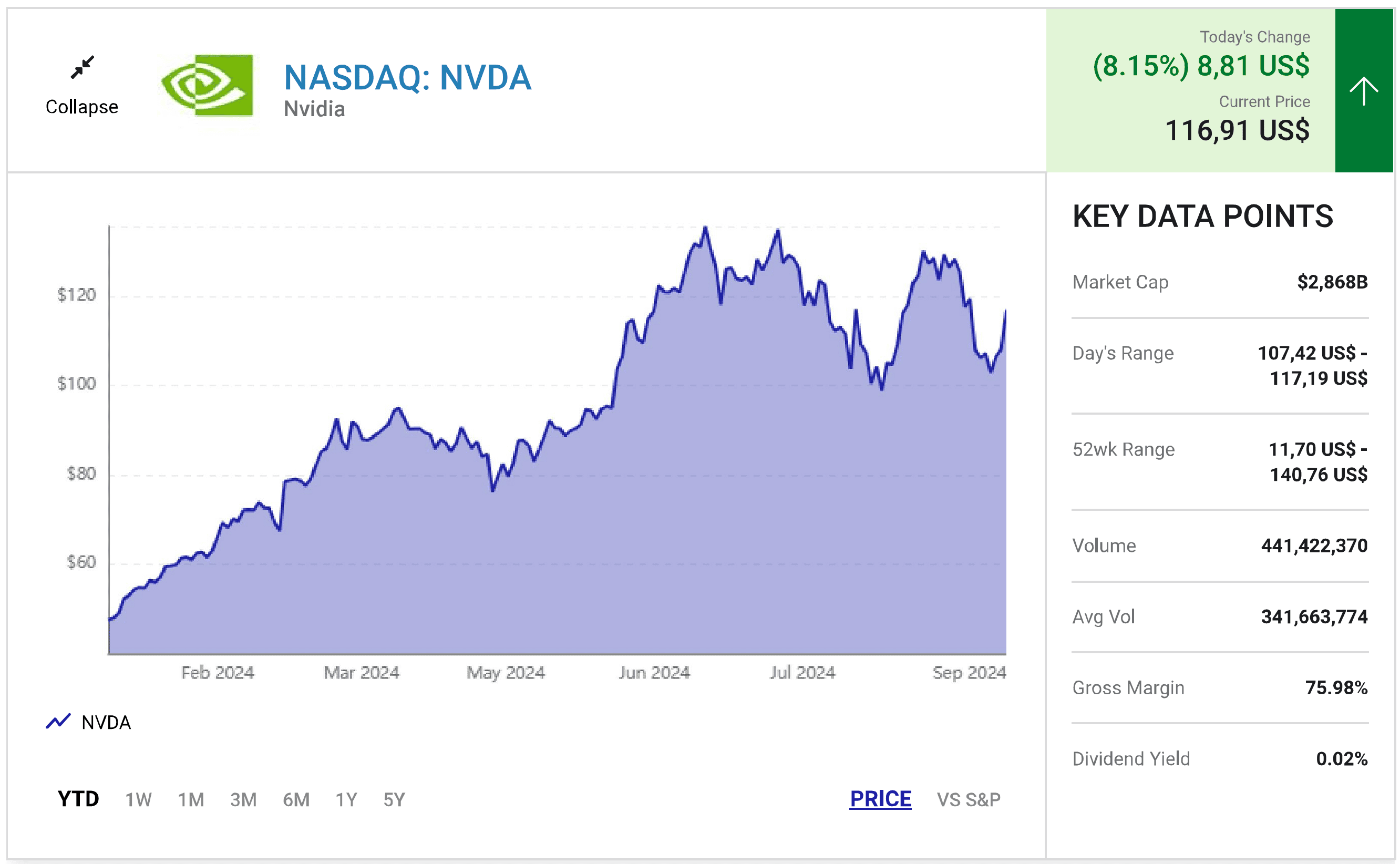

Why Nvidia Stock Popped Today

Why Nvidia Stock Popped Today

12 tháng 9 2024

- August inflation was cooler than expected, setting up the Federal Reserve to cut rates next week.

- Nvidia should benefit from lower interest rates, as it will help its valuation and encourage economic growth and investment in AI infrastructure.

- One news outlet said Nvidia could get permission to export its chips to Saudi Arabia.

Good inflation news and other factors drove Nvidia up today.

Shares of Nvidia (NVDA 8.15%) were moving higher today on several news items, including a cooler-than-expected inflation report this morning, a well-received presentation at a Goldman Sachs conference this morning, and news that the federal government could allow it to export chips to Saudi Arabia. As a result, the stock closed up 8% on the news.

Chip stocks largely jumped as well on the inflation report, with the iShares Semiconductor ETF up 4.6% on the news, and the Nasdaq Composite was up 2.2%.

Image source: Nvidia

Falling interest rates are good for Nvidia

Investors seemed unsure if the CPI report, which showed inflation rising just 2.5% year over year in August, was good news for stocks, but by the afternoon, the Nasdaq was soaring, paced by Nvidia.

The Federal Reserve is expected to cut interest rates next week, but investors are unsure if it will cut rates by 25 or 50 basis points. Ideally, interest rates will come down while the economy remains strong or even gets stronger. That would be the best scenario for Nvidia, as lower rates make growth stocks more valuable, and it should encourage borrowing for investment in artificial intelligence (AI) infrastructure, meaning spending on Nvidia components.

Speaking at Goldman Sachs' Communacopia conference, Nvidia CEO Jensen Huang didn't make any major news, but touted the company's technology and the future of generative AI, noting the company's advantages, including its software libraries for applications like autonomous driving and climate tech. He also added, "Demand is so great that delivery of our components, our technology, infrastructure, and software is really emotional for people because it directly affects their revenue. It directly affects their competitiveness."

Finally, according to a report from Semafor, the federal government is considering permitting Nvidia to export advanced chips to Saudi Arabia, which it would use to train advanced AI models. While Saudi Arabia isn't a huge market, the loosening of export rules would benefit Nvidia and could lead to other markets opening up.

Will Nvidia keep gaining?

Tailwinds seem to be forming for the company, as falling interest rates will support investment and its valuation. It's also set to release the Blackwell platform in Q4, and its top customers, including tech giants like Microsoft, Meta Platforms, and Alphabet, have all said that investing in AI infrastructure is a top priority.

Even after today's gains, Nvidia stock is still down 17% from its high in June, leaving room for more gains. The stock still looks like a good bet to outperform, even after skyrocketing over the last two years.

fool

All information on our website is for general reference only, investors need to consider and take responsibility for all their investment actions. Info Finance is not responsible for any actions of investors.