Share

Homepage

News

Berkshire Hathaway's Mystery Stock Revealed: Here's Why It's an Ideal Warren Buffett Stock

Berkshire Hathaway's Mystery Stock Revealed: Here's Why It's an Ideal Warren Buffett Stock

21 tháng 5 2024

After months of waiting, investors finally learned the identity of the mystery stock Berkshire Hathaway has been scooping up over the past few quarters. The conglomerate added nearly 26 million shares of Chubb (NYSE: CB), the largest publicly traded property and casualty insurance company.

Although investors may have been hoping for something more exciting, Chubb is a prototypical Warren Buffett stock. Buffett has a special affinity for the insurance business and the cash flows they generate, and Chubb is one of the largest, most diversified insurance companies out there. Here's why it was an ideal stock for Buffett and his team at Berkshire.

Warren Buffett has a special place in his heart for insurance companies

Buffett has an affinity for insurance companies that dates back to his time as a student of Benjamin Graham at Columbia Business School. In 1950, Buffett bought $10,000 shares of GEICO, which he sold a couple of years later for $15,000. Buffett also credits Berkshire Hathaway's acquisition of National Indemnity Insurance in 1967 as a pivotal turning point for the company.

The insurance business isn't easy. Companies need to consistently weigh risks on policies and price them so they have enough room to pay for losses and squeeze out a small profit.

Because there is a period of time between collecting premiums and paying out claims, insurance companies essentially have an interest-free loan. This cash, also known as float, is "money we hold and can invest but that does not belong to us," in the words of Warren Buffett.

As old policies lapse and new ones begin, insurers can consistently grow their cash pile and invest it in short-term assets like Treasury bills or longer-term investments like bonds and stocks. This cash generation is a big reason Buffett loves investing in the industry.

Berkshire Hathaway has invested in numerous insurance companies over the years. In 2022, the conglomerate acquired Alleghany for $11.6 billion, adding it to GEICO, Berkshire Hathaway Reinsurance Group, and National Indemnity. It also held a few insurance-focused companies in its portfolio but recently eliminated its holdings in Marsh & McLennan, Globe Life, and Markel -- perhaps to clear space for Chubb.

Chubb is one of the best at pricing risk

Over time, insurance is an excellent business for those who can consistently balance the risks and rewards and underwrite profitable policies.

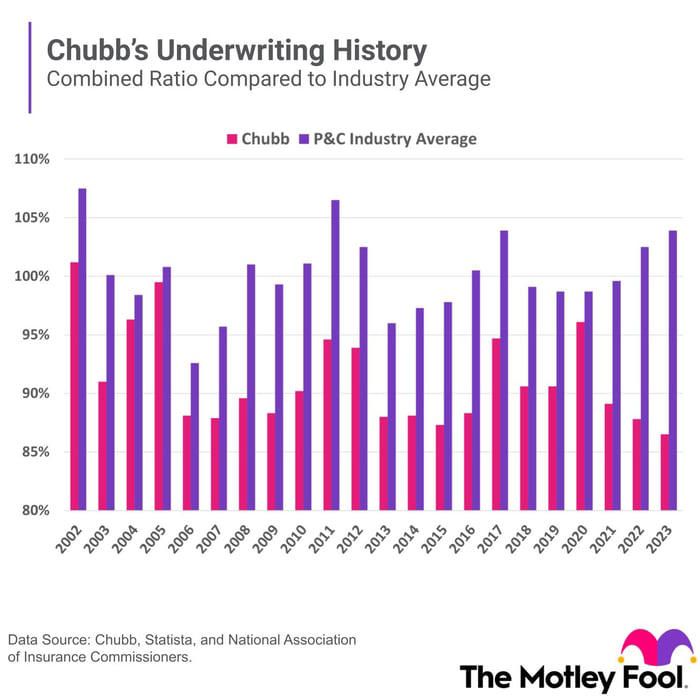

When evaluating an insurer's underwriting ability, the combined ratio can be an excellent starting point. This ratio shows the claims costs plus expenses that go into selling and underwriting policies divided by the premiums collected.

The industry average combined ratio is around 100%, meaning insurers, on average, collect just enough premiums to cover their expenses and claims. When a company consistently beats its industry peers, you have a good candidate for a long-term investment.

Chubb is a diversified insurer that writes policies covering commercial property and casualty, personal lines like automotive or homeowners insurance, accident and health, agriculture, and reinsurance. The diversified insurance company has displayed a stellar history of underwriting profitable policies, with its combined ratio averaging 91% over the past two decades while consistently beating industry peers.

All information on our website is for general reference only, investors need to consider and take responsibility for all their investment actions. Info Finance is not responsible for any actions of investors.