Share

Homepage

News

New Allegations of Fraudulent Behavior by Multibank on InfoFinance

New Allegations of Fraudulent Behavior by Multibank on InfoFinance

05 tháng 7 2024

In today's modern financial market, trust is the cornerstone of a trading platform's success. However, when promises turn into fraudulent actions, that trust is shattered, and investors suffer significant losses. InfoFinance, a center for recording and resolving complaints from the investor community, has recently received numerous allegations regarding one of the most controversial trading platforms - Multibank. Let's delve into the latest details to better understand the new accusations of fraudulent behavior by Multibank.

Murky Operational Licenses and Suspicious Name Changes

Murky Legal Standing

One of the crucial factors in determining a trading platform's credibility is its operational license. However, Multibank has failed to comply with this requirement, severely impacting their ratings on financial websites.

Multibank previously claimed to hold licenses from prestigious financial authorities such as ASIC, BaFin, CNMV, FSC, FMA, and RAK. However, recent revelations by credible financial experts and websites have exposed that Multibank is currently not regulated by any financial institution.

.

Frequent Name Changes

When Multibank first entered the financial market, it operated under the name IKON. After some time, it rebranded as MEXGroup. Yet, not stopping there, to gain investor trust, the platform renamed itself Multibank, a name easily confused with a reputable bank.

However, their fraudulent practices were quickly uncovered. Many investors have continuously accused Multibank of fraud and misappropriating client funds. Moreover, the platform has been accused by its own employees in Vietnam of withholding wages and providing poor working conditions.

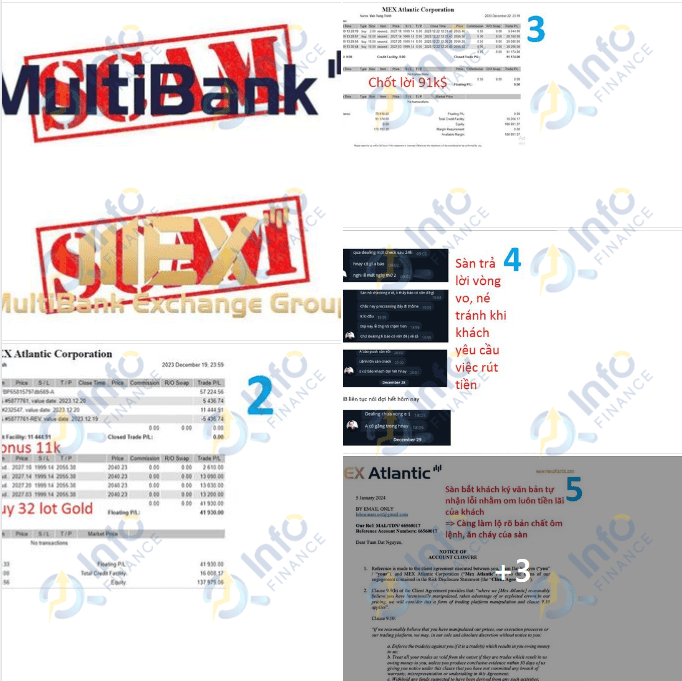

MEXGroup's Past Frauds

Discussing Multibank's current frauds, one cannot overlook the dark history of MEXGroup. MEXGroup blatantly misappropriated client funds, from profitable trade orders to deposited capital. They intervened and wiped out all winning trade orders from clients.

Furthermore, the platform frequently delays client withdrawals, causing extreme concern among investors. Moreover, MEXGroup often delays trade orders and slows down the order processing of traders.

Despite being headquartered in China, MEXGroup registered company profiles in the United States and established virtual offices. This was one of their tactics to deceive clients, evading taxes and falsifying documents and awards. Fake competitions with luxury car prizes or virtual money are tricks that anyone who has traded with them will surely know.

Slowing down investor orders

As mentioned earlier, like other fraudulent trading platforms, Multibank also takes advantage of and slows down client orders to embezzle money. When investors' orders are delayed and lead to losses, naturally, Multibank benefits.

When this situation occurs too many times and affects many investors, they tried to defend themselves but did not receive any response, nor did they have any representative to protect their rights.

Deleting trader winning orders

When investors win big, they have money, and vice versa when they lose. However, Multibank does not want to, so they used tricks to delete winning trades from traders. It can be said that most of the people who opened accounts with this platform have experienced losing results, but do not know the exact reason from where.

The most obvious example of eliminating profits from customers is:

An investor earned a large profit of up to $ 2,821.24 and $ 3,900, but was removed by the platform. The reason for this action is: "We have the right to delete transactions under 120 seconds."

Another example, they also erased a $ 4,700 profit with the reason: "We have the right to delete transactions not recorded due to errors on the chart."

Build trust by company name

Naming the company like a bank is a smart strategy. MultiBank changed its name from February 18, 2018, and set up headquarters at 11/F Convoy 169 Electric Road North Point.

However, the reality is that this company only has headquarters in Hong Kong, China, but operates under the guise of a computer software company and is not recognized by any financial agency.

The name MultiBank is also used to conduct marketing campaigns to attract customers. But the end result is that the exchange was caught by Hong Kong police and the money of investors was lost from then on.

The presence of non-transparent exchanges like Multibank not only threatens investment capital but also undermines the trust of both the industry and individual investors. InfoFinance is currently a reliable destination for those who feel they have been harmed by unethical behavior from trading platforms. This is where stories like Multibank's will no longer recur, and where the investor community can be protected and sustainably developed in the future.

All information on our website is for general reference only, investors need to consider and take responsibility for all their investment actions. Info Finance is not responsible for any actions of investors.

Related news

29 Jun 2025