Share

Homepage

News

US national debt passes $35T — 5 Things to know in Bitcoin this week

US national debt passes $35T — 5 Things to know in Bitcoin this week

30 tháng 7 2024・ 03:21

Bitcoin bulls demand a rematch with final resistance below all-time highs to start the week as BTC price upside puts $70,000 back in play.

Bitcoin sets up a crunch climax to July at $70,000 comes into view in time for the monthly close.

In what promises to be a frantic few days for BTC price action, bulls are attempting to claw back lost support at key psychological levels.

Can they succeed? This is the question on everyone’s lips going forward as Bitcoin returns to price points absent for nearly two months.

Cointelegraph takes a closer look at these topics as BTC/USD lines up an important retest of final resistance before all-time highs.

Bitcoin bounces back to grill final BTC price resistance

Bitcoin bulls got a last-minute reprieve at the latest weekly close as the one-week candle edged from red to green.

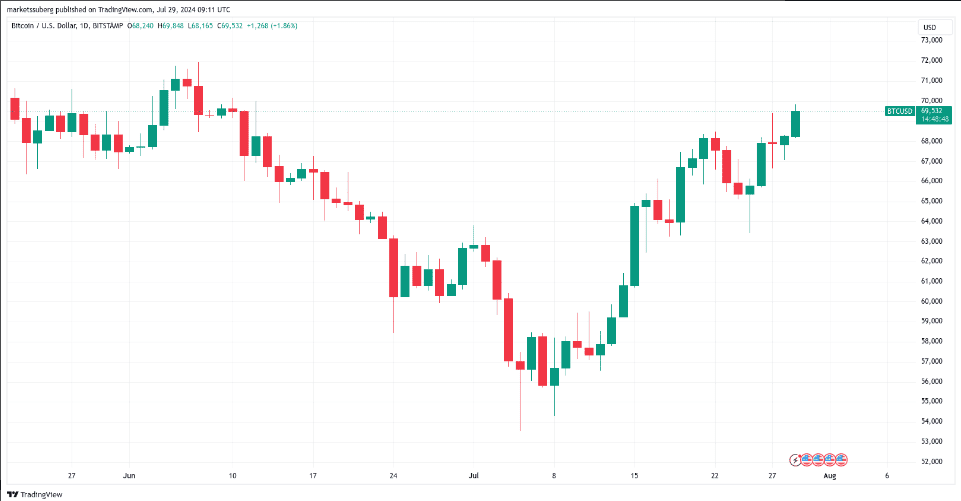

At around $68,265 on Bitstamp, per data from Cointelegraph Markets Pro and TradingView, Bitcoin rounded out a hectic weekend at what became a launch level for further gains into the July 29 Asia trading session.

New multiweek highs came as a result, with BTC/USD reaching $69,848 for the first time since June 10.

BTC/USD 1-day chart. Source: TradingView

Unsurprisingly, traders are in a positive mood as Bitcoin approaches key resistance below March’s all-time highs.

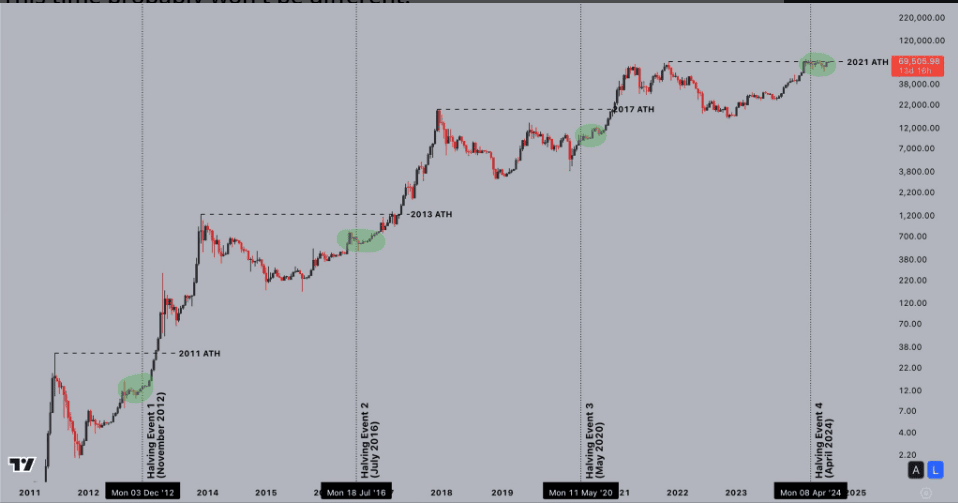

“Every halving event, Bitcoin goes through a couple months of choppy price action,” popular trader Jelle wrote in one of his latest posts on X. “Once that phase comes to an end, the true bull market starts. This time probably won't be different.”

Bitcoin price comparison. Source: Jelle

FOMC week begins with US debt milestone

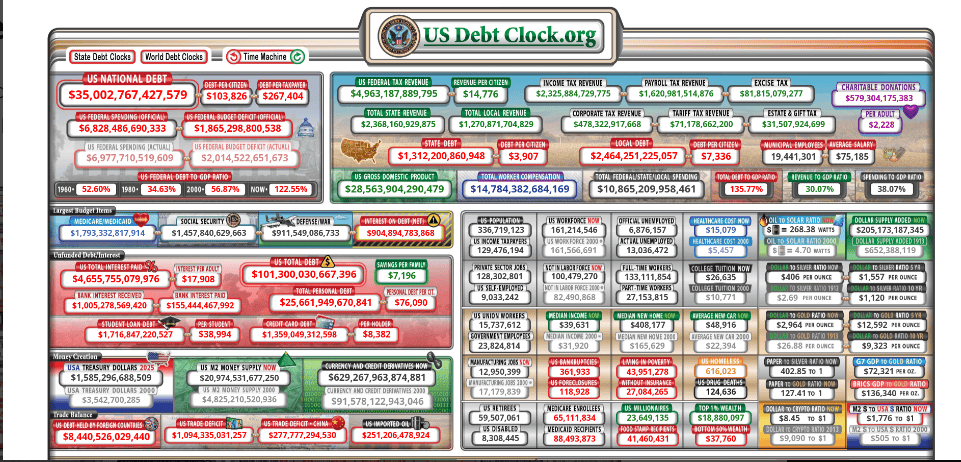

As US national debt hits $35 trillion for the first time in history, the power to move crypto markets lies to a large extent with Fed Chair Jerome Powell this week.

Source: US Debt Clock

His press conference, which will follow the latest Federal Open Market Committee (FOMC) decision on interest rates, can dictate longer-term expectations for economic policy simply by the tone of language used.

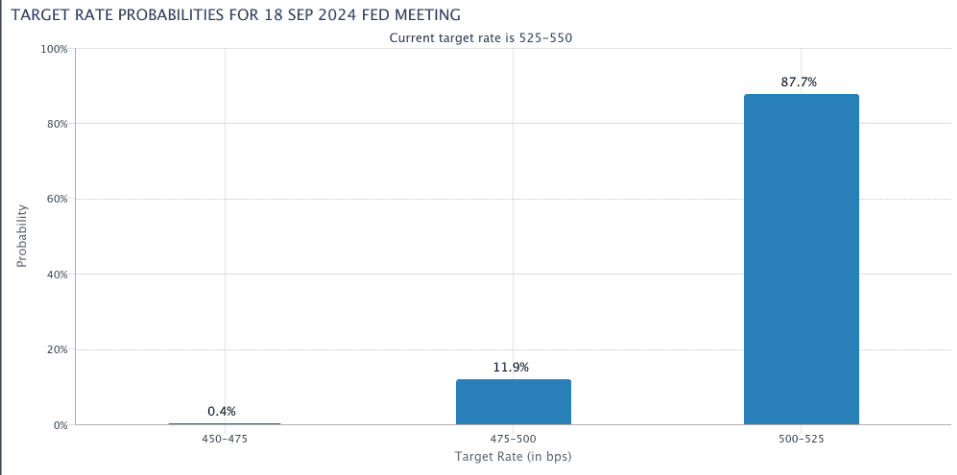

That said, markets see few surprises from the decision itself — no rate cuts are expected until the next FOMC meeting in September.

The latest estimates from CME Group’s FedWatch Tool put the odds of rates staying the same this month at nearly 96%. Conversely, they have fully priced in a cut in some form for September.

Fed target rate probabilities for September FOMC meeting. Source: CME Group

Those cuts are the key focus for crypto and risk-asset traders, as their presence should boost overall investment liquidity.

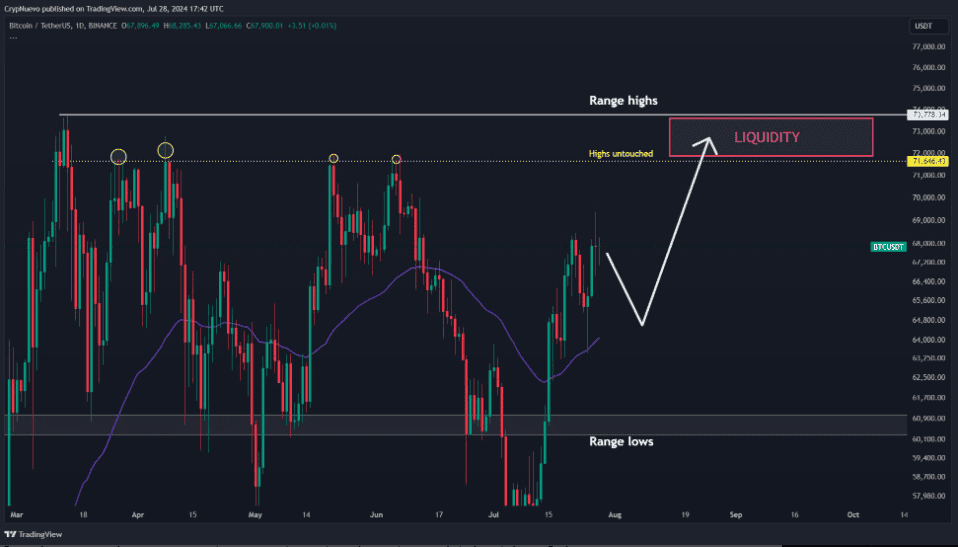

Commenting on the macro week ahead, popular trader CrypNuevo warned that Powell may play it safe and avoid any firm commitment to cuts.

As such, BTC/USD may retrace post-FOMC, while high-timeframe analysis still calls for a retest of liquidity around all-time highs.

BTC/USDT cha. Source: CrypNuevo

Bitcoin mining difficulty set for new highs

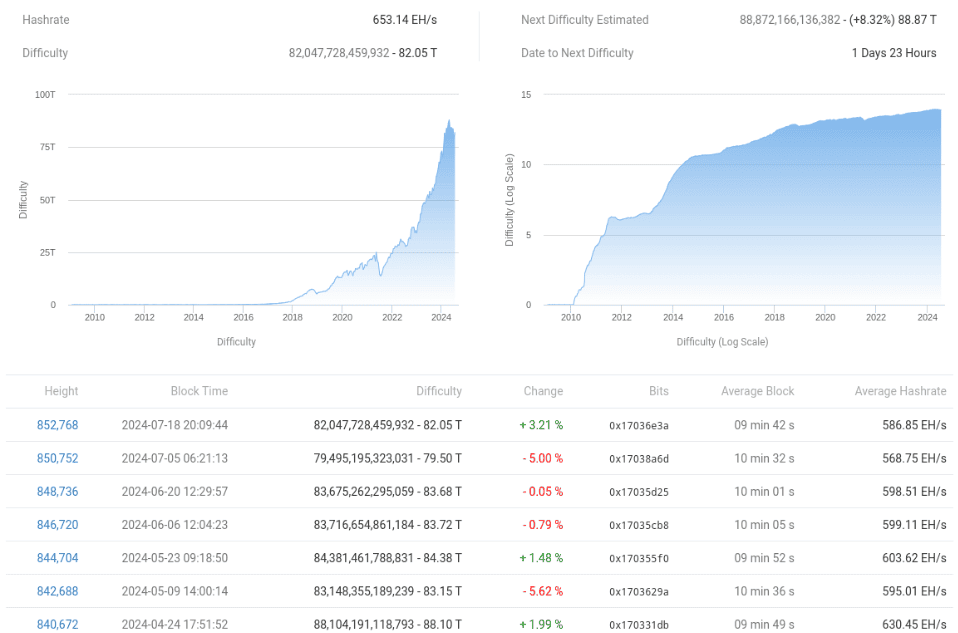

Bitcoin network fundamentals overview (screenshot). Source: BTC.com

The latest estimates from monitoring resource BTC.com calculate that on July 31, Bitcoin mining difficulty will hit new all-time highs.

These will come if a giant 8% difficulty increase becomes a reality; this is nonetheless dependent on miners' cost-effectiveness.

That surge would follow a 3.2% uptick from two weeks prior, and take difficulty to 88.61 trillion.

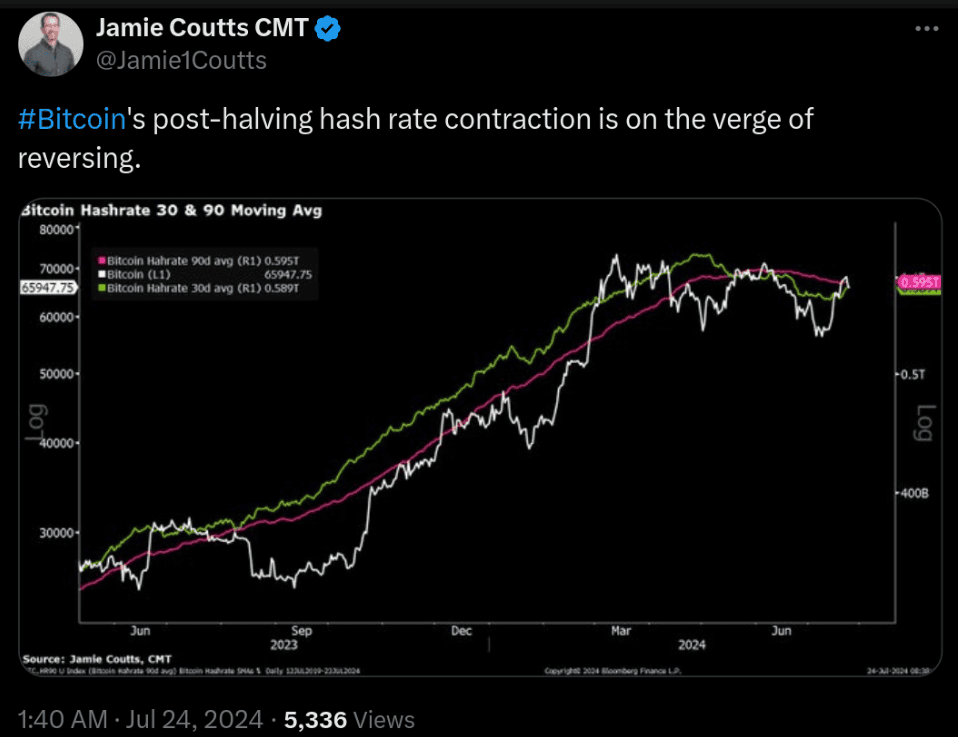

Source: Jamie Coutts

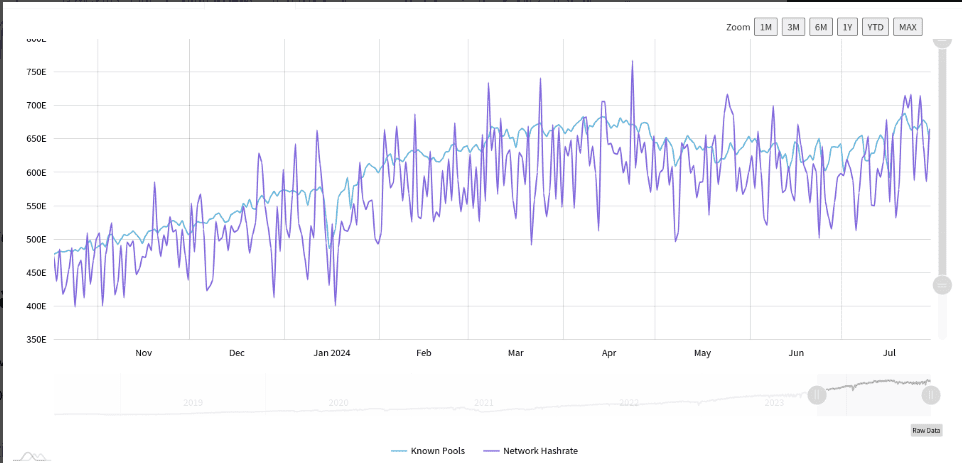

The latest raw data from MiningPoolStats continues to show hashrate coiling below all-time highs of its own — currently at 665 exahashes per second (EH/s) at the time of writing.

Bitcoin hashrate raw data (screenshot). Source: MiningPoolStats

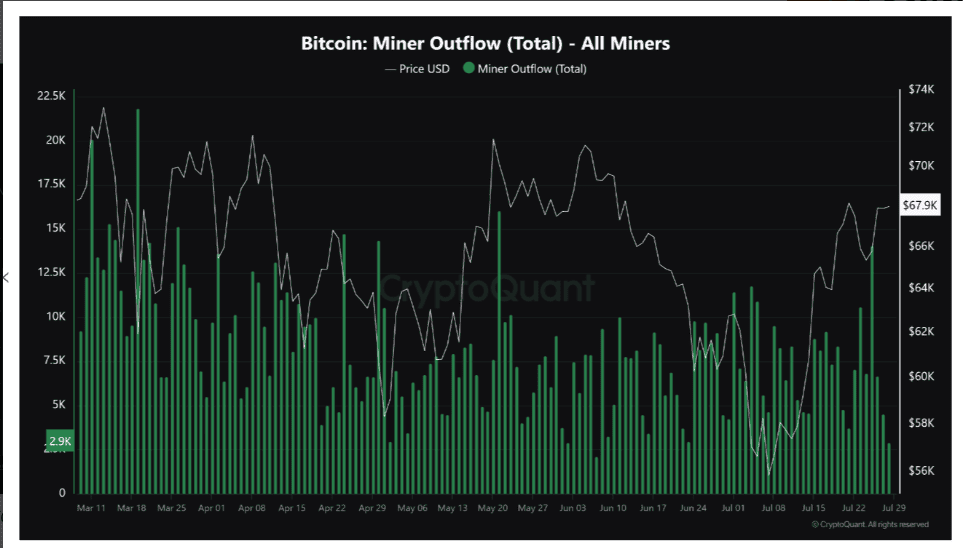

Concern as BTC miner selling resurfaces

Analyzing the overall profitability of the mining sphere, however, on-chain analytics platform CryptoQuant warned that it is still early days for the comeback.

The miner position index (MPI), contributor XBTManager noted, remains at a “very low level.”

“This adds some selling pressure to the current structures but doesn’t create a significant overall selling pressure,” he wrote in one of CryptoQuant’s Quicktake blog posts.

XBTManager appeared more concerned about BTC leaving known miner wallets, suggesting that selling is accelerating, not abating, at current price levels.

“After a support level of $53,000, miner outflow continues to rise,” he explained. “Bitcoin has been observed leaving miner wallets at the current price level, which could create potential selling pressure. A similar example was seen on May 21.”

Bitcoin miner outflow chart (screenshot). Source: CryptoQuant

That date coincided with a trip above $71,000 for BTC/USD, this level forming a local high before the $53,000 lows hit at the start of July.

cointelegraph

All information on our website is for general reference only, investors need to consider and take responsibility for all their investment actions. Info Finance is not responsible for any actions of investors.