Share

Homepage

News

1 Stock-Split ETF That Could Turn $500 Per Month Into $1 Million, With Nvidia's Help

1 Stock-Split ETF That Could Turn $500 Per Month Into $1 Million, With Nvidia's Help

12 tháng 7 2024

Exchange-traded funds can eliminate the need for investors to pick winners and losers in fast-moving industries like artificial intelligence (AI).

The artificial intelligence (AI) industry is still very young, but investors have already observed its incredible potential to create value. Nvidia, for example, added $2.8 trillion to its market capitalization since the start of 2023 alone. However, AI is evolving quickly, and picking the winners and losers over the long term won't be easy.

Buying an exchange-traded fund (ETF) can be a great solution to that challenge for most investors. The iShares Expanded Tech Sector ETF (IGM -2.22%) holds every leading AI stock investors could want, so it's a solid candidate to consider.

The iShares Expanded Tech Sector ETF just completed a stock split

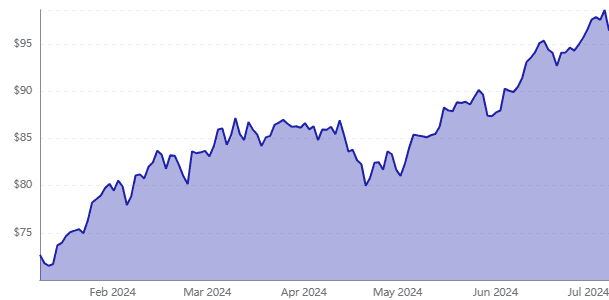

The iShares ETF delivered a compound annual return of 21.7% over the last five years, far outpacing the average annual return of 15.7% in the S&P 500 index over the same period.

As a result, the iShares ETF was trading above $510 in March, which made it relatively expensive for smaller investors to buy. To fix that problem, iShares executed a 6-for-1 stock split that increased the number of shares in circulation sixfold and organically reduced the price per share by a proportional amount.

The stock split hasn't changed the underlying value of the ETF, but one share now trades for under $100, which makes it accessible to a broader investor base. AI could drive further momentum for the fund; here's how it could turn $500 per month into $1 million over the long term.

The iShares ETF holds every popular AI stock investors could want

Many AI-specific ETFs have hit the market over the last few years, but they typically hold a small number of stocks. The iShares ETF, however, has the benefit of a broad portfolio with 281 holdings representing not only AI, but also cloud computing, enterprise software, streaming, cybersecurity, and more.

With that said, the top 10 holdings in the iShares ETF account for 53.7% of the entire value of its portfolio. Most of the leaders in AI are included in that top 10, so investors do get a relatively high exposure to this fast-growing industry:

Apple just crossed $3.5 trillion in market capitalization, making it the world's largest company once again after briefly slipping behind Microsoft. Its new Apple Intelligence software (developed in partnership with OpenAI) will transform the Siri voice assistant, and it will allow users to rapidly craft content in Notes, Mail, iMessage, and more. Apple has 2.2 billion active devices globally, so it could become the largest distributor of AI to consumers.

Microsoft agreed to invest $10 billion in OpenAI in December 2023, and it used the start-up's technology to create its Copilot virtual assistant. Copilot is accessible in core products like Windows and 365 (Word, Excel, PowerPoint, and more) to help users boost their productivity. Plus, developers can use OpenAI's latest GPT-4 models to create their own AI applications through the Microsoft Azure cloud platform.

None of the above would be possible without Nvidia. Its graphics processing units (GPUs) for the data center have trained the world's most advanced AI models to date -- including GPT-4 -- and red-hot demand for those chips has sent the company's revenue soaring.

The iShares ETF owns other popular AI stocks like Oracle and Micron Technology, which sit outside its top 10. Beyond AI, it also owns cybersecurity stock Palo Alto Networks, cloud software stock Datadog, and social media stock Pinterest, which are just a few notable names.

All information on our website is for general reference only, investors need to consider and take responsibility for all their investment actions. Info Finance is not responsible for any actions of investors.

Related news

29 Jun 2025