Share

Homepage

News

AbbVie Could Soar 24%, According to a Wall Street Analyst. Is the High-Yield Dividend Stock a Buy Now?

AbbVie Could Soar 24%, According to a Wall Street Analyst. Is the High-Yield Dividend Stock a Buy Now?

23 tháng 7 2024

The big pharma company's top drug is losing ground, but its dividend keeps rising.

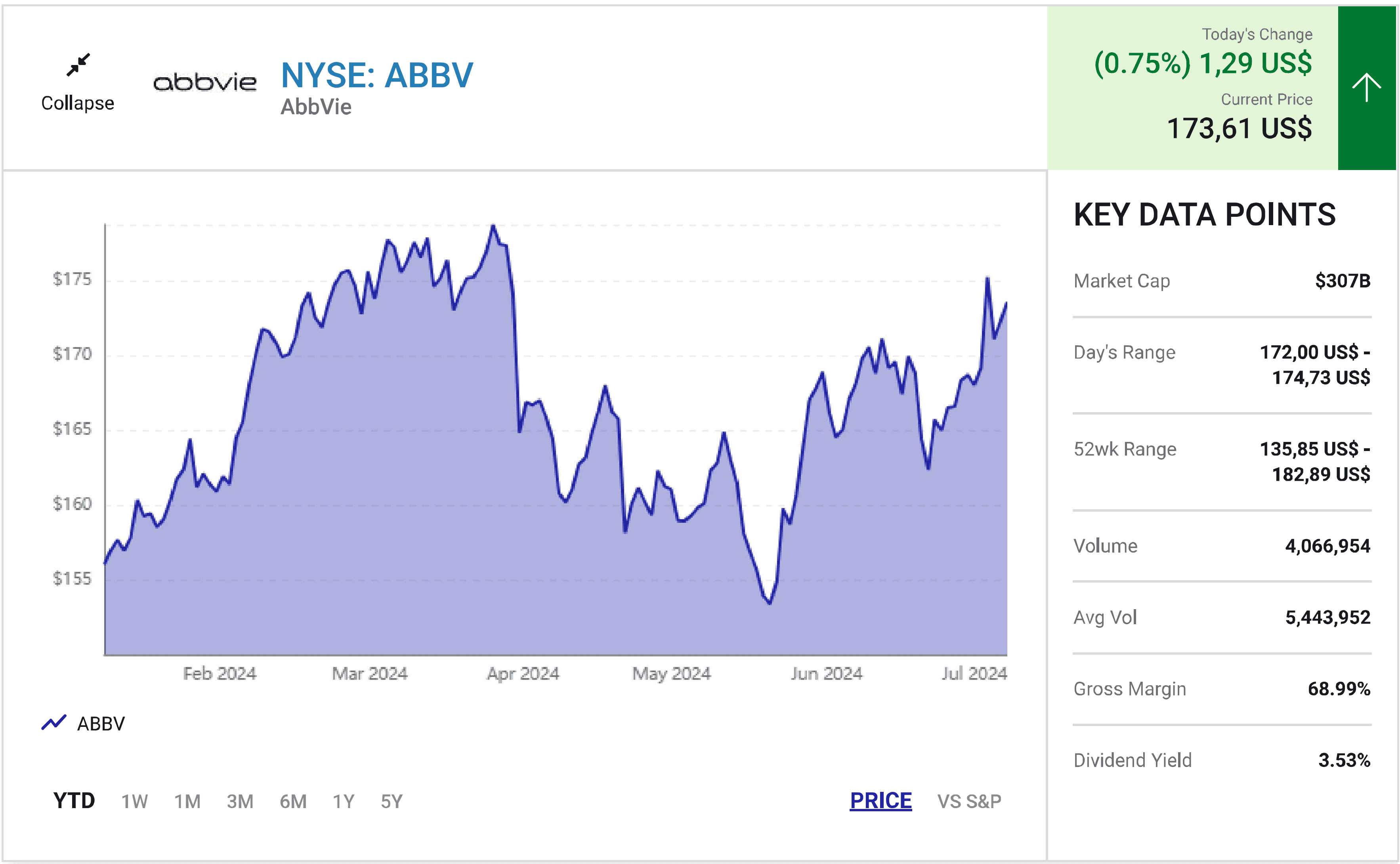

Shares of Big Pharma company AbbVie (ABBV 0.75%) inched higher recently in response to positive news from a Wall Street investment bank. BMO Capital analyst Evan Seigerman raised his price target on the stock from $180 to $214 per share on Friday, July 19.

Bullishness for AbbVie might seem foolhardy to the casual observer. The company's lead drug, Humira, finally lost patent-protected exclusivity in the U.S. market last year, and earnings are down.

Humira is under pressure, but AbbVie's dividend is still rising. At recent prices, it offers a 3.6% yield that is more than double what you'd receive from the average stock in the S&P 500 index. Let's look at the reasons Seigerman is enthusiastic about this stock despite an enormous patent cliff.

PBMs, Rinvoq, and Skyrizi to the rescue

First-quarter Humira sales in the U.S. market, where it lost exclusivity in 2023, declined 39.9% year over year to an annualized $7.1 billion. The decline is upsetting, but investors should be encouraged because it could be much worse.

Last July, Mark Cuban's Cost Plus Drugs began offering Yusimry, a biosimilar version of Humira, for about $570. At the time, the same quantity of branded Humira was priced at $6,922.

Pharmacy benefits managers (PBMs) receive enormous rebates when you fill a Humira prescription but nothing if you go directly to Cost Plus Drugs. The largest PBMs are also run by the nation's largest insurers: UnitedHealth Group, CVS Health, and Cigna. As a result, most Americans never hear about how much they could save by ignoring the insurer their employer hired to keep prices low.

AbbVie is also benefiting from smart investments it made with Humira profit many years ago. Rinvoq, an arthritis treatment, and Skyrizi, a psoriasis treatment, first earned approval from the Food and Drug Administration (FDA) in 2019, and they're already offsetting Humira's losses. First-quarter earnings contracted slightly, but total sales rose by 0.7% year over year despite Humira's loss of exclusivity.

Rinvoq and Skyrizi sales aren't finished climbing. Rinvoq earned approval to treat Crohn's disease last year, and Skyrizi recently earned approval to treat ulcerative colitis. Management expects combined annual sales of these two treatments to exceed $27 billion in 2027.

More dividend raises ahead

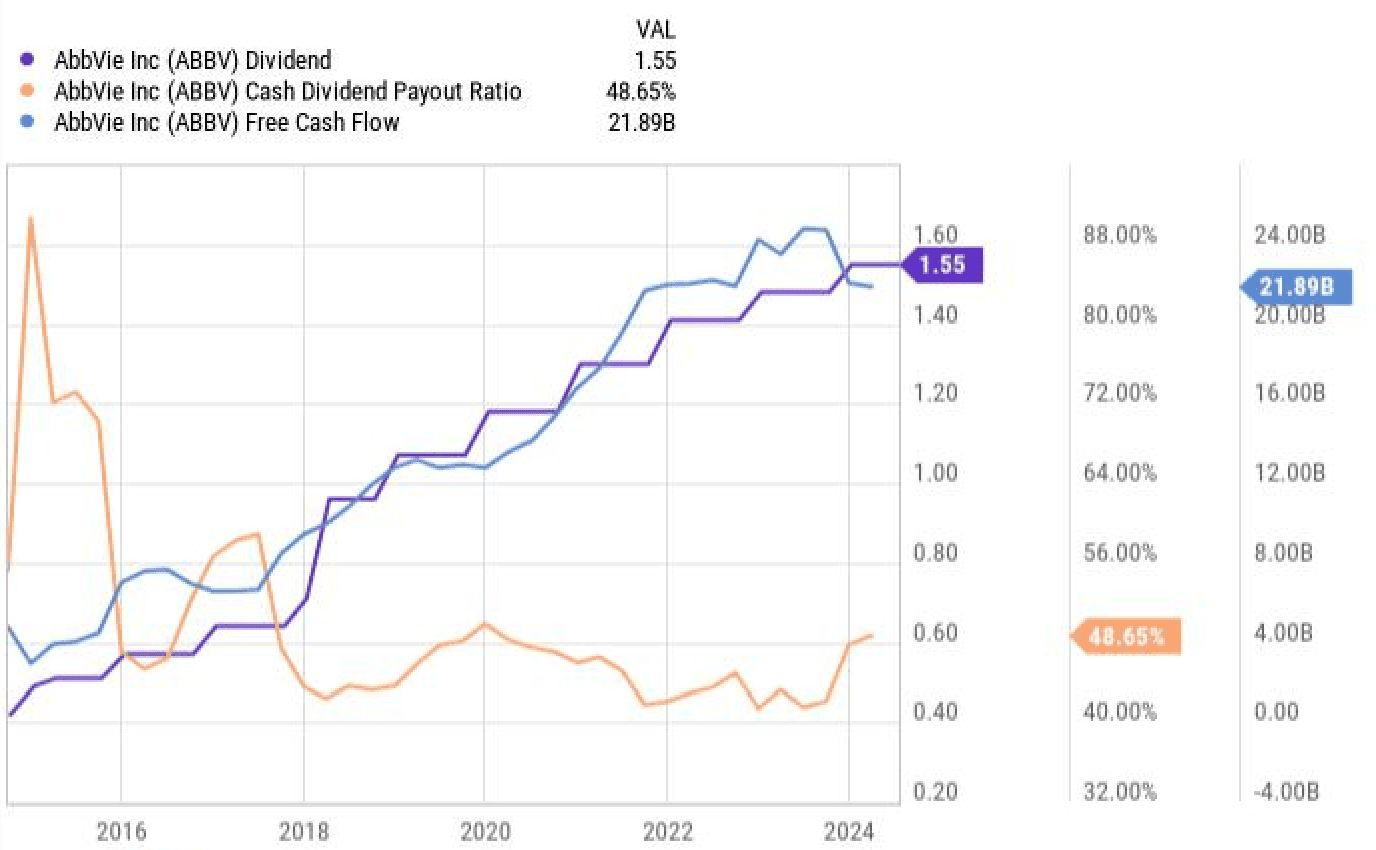

AbbVie has raised its dividend every year since spinning off from Abbott Laboratories in 2013. Those payout raises have been pretty big ones, too. Investors holding on for the last 10 years have seen their quarterly payments shoot 269% higher.

ABBV DIVIDEND DATA BY YCHARTS

There are no guarantees that AbbVie can more than triple its dividend payout again over the next 10 years, but it could happen. Despite being in the middle of a patent cliff, the drugmaker recorded $21.9 billion in free cash flow over the past 12 months. The company needed less than half of this amount to meet its dividend obligation, so there's plenty of room for significant payout bumps in the years ahead.

A buy now

Drug patents have relatively short lives, so pharmaceutical businesses like AbbVie always have many parts moving in opposite directions. AbbVie's a great dividend stock to buy now and hold over the long run because its growth drivers can more than offset losses from Humira, Imbruvica, and cosmetic Botox.

There will probably be enough new growth drivers emerging from AbbVie's pipeline to continue growing profit and dividends for at least another decade. As of this February, the company had more than two dozen molecules in mid- to late-stage clinical trials.

fool

All information on our website is for general reference only, investors need to consider and take responsibility for all their investment actions. Info Finance is not responsible for any actions of investors.