Share

Homepage

News

Best Stock to Buy Right Now: Amazon vs. Walmart

Best Stock to Buy Right Now: Amazon vs. Walmart

09 tháng 4 2024

Amazon (NASDAQ: AMZN) and Walmart (NYSE: WMT) stand as the two largest companies in the United States by sales, sharing similarities as well as distinct differences. Both have undergone share splits in recent years, with Walmart's most recent split occurring just last month, and both companies are currently experiencing an upward trajectory in their stock performance. The question arises: which one presents a better investment opportunity today? Let's delve into the analysis.

The Case for Amazon: Diverse Revenue Streams

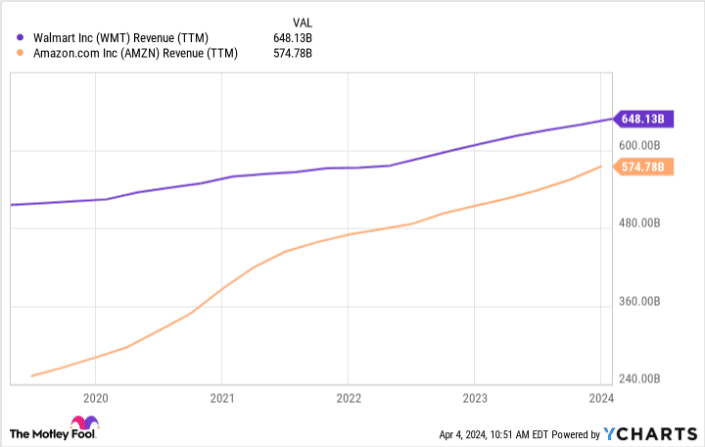

Amazon, with $575 billion in net sales in 2023, closely trails behind Walmart in terms of size. However, its dominance in e-commerce is significantly ahead of Walmart, capturing 37.6% of all U.S. e-commerce sales compared to Walmart's distant 6.4%. With the continuous growth of e-commerce as a proportion of retail sales, Amazon is steadily closing the gap on Walmart's overall retail dominance.

Yet, Amazon's business extends far beyond e-commerce. While e-commerce sales represent a substantial portion, accounting for 67% of its total fourth-quarter revenue, the company also operates Amazon Web Services (AWS), a leading cloud computing business comprising 14% of its total sales. Additionally, its advertising segment is experiencing rapid growth, expanding by 27% year over year in the fourth quarter, poised to become a significant revenue generator. Moreover, Amazon boasts other ventures such as its competitive streaming business, augmented by its acquisition of MGM Studios, and a burgeoning healthcare division.

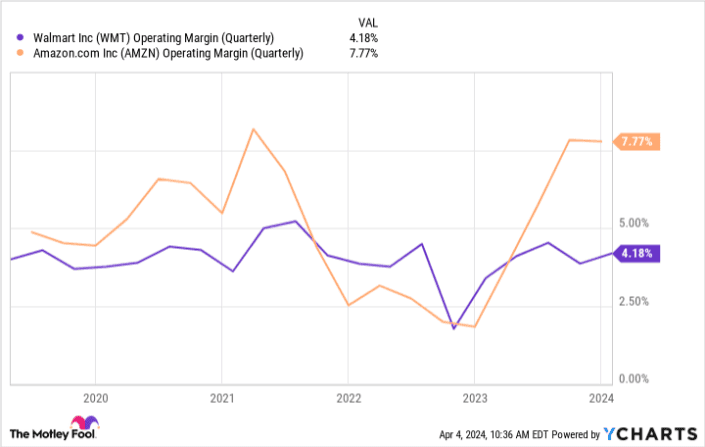

Overall, Amazon's revenue growth outpaces Walmart's, recording a 14% year-over-year increase in 2023. Despite facing pressure in 2022, Amazon typically maintains a higher operating margin.

Amazon benefits from various revenue streams, including investments in artificial intelligence (AI), which has yielded a suite of AI tools catering to a diverse clientele. This technological edge positions Amazon for sustained growth and continued expansion.

The Case for Walmart: Unrivaled Market Presence

While Amazon exhibits faster growth rates, Walmart's revenue increased by 5.7% year over year in fiscal 2024, building upon a larger revenue base. Operating 10,500 stores worldwide, including over 4,600 in the U.S. alone, Walmart possesses an extensive retail network. Far from saturation, Walmart plans to open 150 supercenters and 30 new Sam's Club stores over the next five years, alongside remodeling nearly 300 U.S. stores.

Despite the rise of e-commerce, Walmart's brick-and-mortar stores remain a cornerstone of its business, attracting customers with competitive prices. This emphasis on physical retail contributes to Walmart's modest operating margin, emphasizing sales volume over high margins, particularly in the grocery sector.

While Walmart's business portfolio may not match the breadth of Amazon's, its recent acquisition of streaming platform Vizio presents opportunities to expand its advertising business and compete with Amazon in the digital space.

Additionally, Walmart's dividend payout appeals to income-oriented investors, a feature absent in Amazon's investment proposition.

Better Buy: The Verdict

Both Amazon and Walmart offer compelling investment prospects, catering to different investor preferences. Growth-oriented investors may favor Amazon for its proven track record, sustained profitability, and expansive growth potential across various sectors, particularly in AI.

Conversely, risk-averse or dividend-seeking investors may find Walmart's established market presence and dividend payout more appealing.

However, if forced to choose, Amazon emerges as the preferred option. With its track record of innovation, diversified revenue streams, and leadership in AI, Amazon presents a compelling long-term investment opportunity, suitable for most portfolios.

All information on our website is for general reference only, investors need to consider and take responsibility for all their investment actions. Info Finance is not responsible for any actions of investors.