Share

Homepage

News

Bitcoin price uptrend ‘intact’ with hodlers 120% in profit — Research

Bitcoin price uptrend ‘intact’ with hodlers 120% in profit — Research

20 tháng 6 2024

Bitcoin hodlers face “boredom and apathy” but are not engaging in mass distribution — even as the BTC price dip erodes unrealized profits.

Bitcoin is still “largely profitable” despite months of sideways BTC price action, says new research.

In the latest edition of its weekly newsletter, The Week On-Chain, published on June 18, analytics firm Glassnode dispelled myths over investors’ unrealized losses.

BTC price analysis flags “investor boredom and apathy”

Bitcoin may be trading within a rigid corridor, but the majority of hodlers are not seeing a return on investment evaporate as a result.

Summarizing current BTC price behavior as “establishing equilibrium,” Glassnode pointed to multiple on-chain metrics showing Bitcoin in a period of consolidation — not capitulation.

“Sideways price movement tends to manifest as investor boredom and apathy, which appears to be the dominant response across all Bitcoin markets,” it wrote.

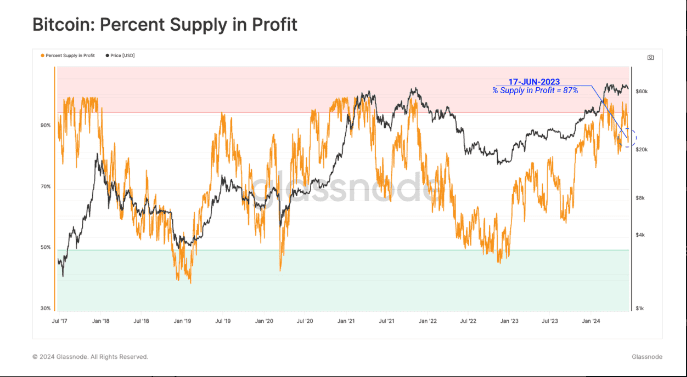

“BTC prices are consolidating within a well-established trade range. Investors remain in a generally favourable position, with over 87% of the circulating supply held in profit, with a cost basis below the spot price.”

Bitcoin % supply in profit (screenshot). Source: Glassnode

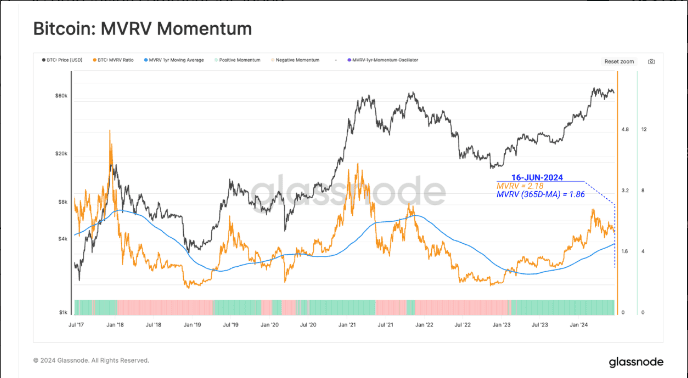

Using the market value to realized value (MVRV) metric, researchers showed that on aggregate, a given amount of BTC is still up by more than two times, or 120%, versus its purchase price in United States dollar terms. The one-year average value of MVRV is currently 86%.

“The MVRV Ratio remains above its yearly baseline, suggesting that the macro uptrend remains intact,” accompanying commentary added.

Bitcoin MVRV momentum (screenshot). Source: Glassnode

Bitcoin speculators refuse to capitulate

The newsletter’s mood contrasts with some of the more panicked reactions to this week’s BTC price drop.

As Cointelegraph continues to report, traders are wary of support trendlines disintegrating and multimonth lows reappearing as a result.

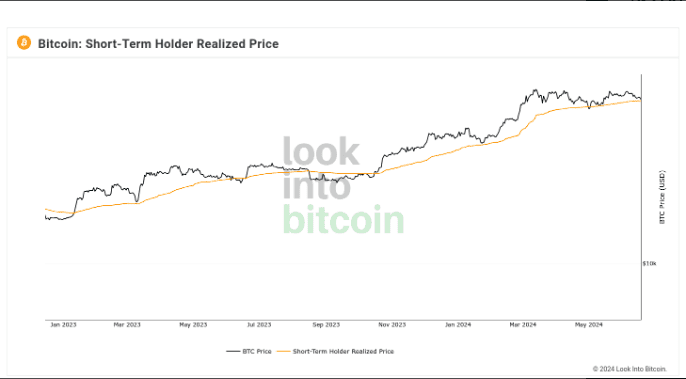

Among the most important lines in the sand now on the radar is the aggregate purchase price for Bitcoin’s speculative investor base, the so-called short-term holders (STHs).

The latest data from statistics resource LookIntoBitcoin puts the STH cost basis at $64,000.

Bitcoin STH realized price. Source: LookIntoBitcoin

Despite seeing unrealized gains fading, STH entities themselves are not preparing for a mass sell-off at current prices, Glassnode states.

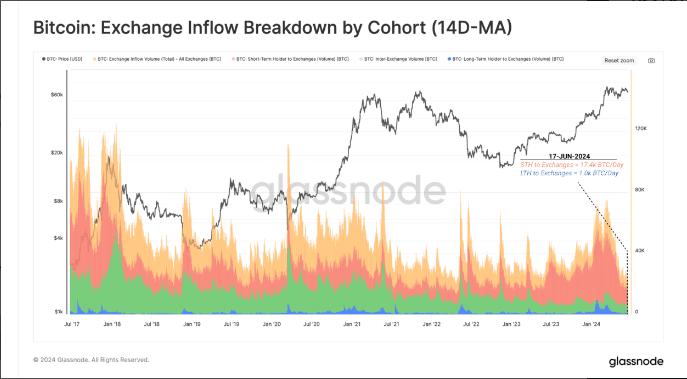

“At present, Short-Term Holders are sending around +17.4k BTC/day to exchanges,” it calculated. “However, this is markedly lower than the peak of +55k BTC/day recorded as the market hit the $73k ATH in March, where speculation levels were becoming excessive.”

Bitcoin exchange inflows (screenshot). Source: Glassnode

Traders anticipate a move from the ‘sideways chop’ in near term

Bitcoin is currently trading at $64,966, down 2.35% over the past 30 days, according to CoinMarketCap data. It is down 12% from its all-time high of $73,679 in March. CryptoQuant’s pseudonymous author, IT Tech, believes this could be a “market bottom.”

Altcoins have suffered more heavily in the last week. Major altcoins like Solana’s (SOL), Dogecoin (DOGE) and Shiba Inu (SHIB) have experienced seven-day declines of 8.23%, 11.67%, and 16.31%, respectively.

Global Macro Investor (GMI) head of research Julien Bittel commented that Bitcoin’s lack of price movement indicates it is in a “period of sideways chop,” while other traders anticipate a directional shift in the near term.

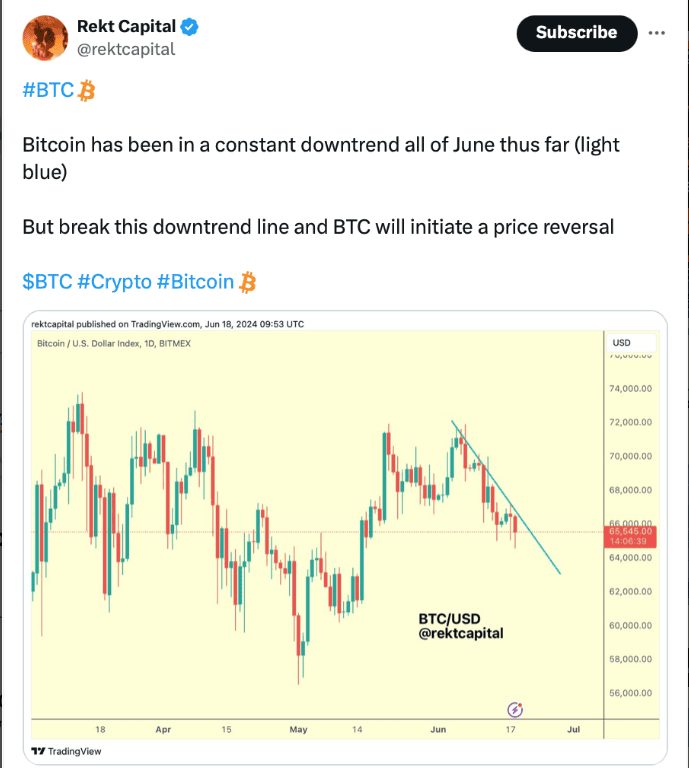

“Break this downtrend line and BTC will initiate a price reversal,” pseudonymous crypto trader Rekt Capital wrote on June 18, after acknowledging that Bitcoin has been in a “constant downtrend” all of June.

Source: Rekt Capital

cointelegraph

All information on our website is for general reference only, investors need to consider and take responsibility for all their investment actions. Info Finance is not responsible for any actions of investors.

Related news

29 Jun 2025