Share

Homepage

News

Bitcoin whales snapped up $4.3B of BTC amid price slump

Bitcoin whales snapped up $4.3B of BTC amid price slump

15 tháng 7 2024

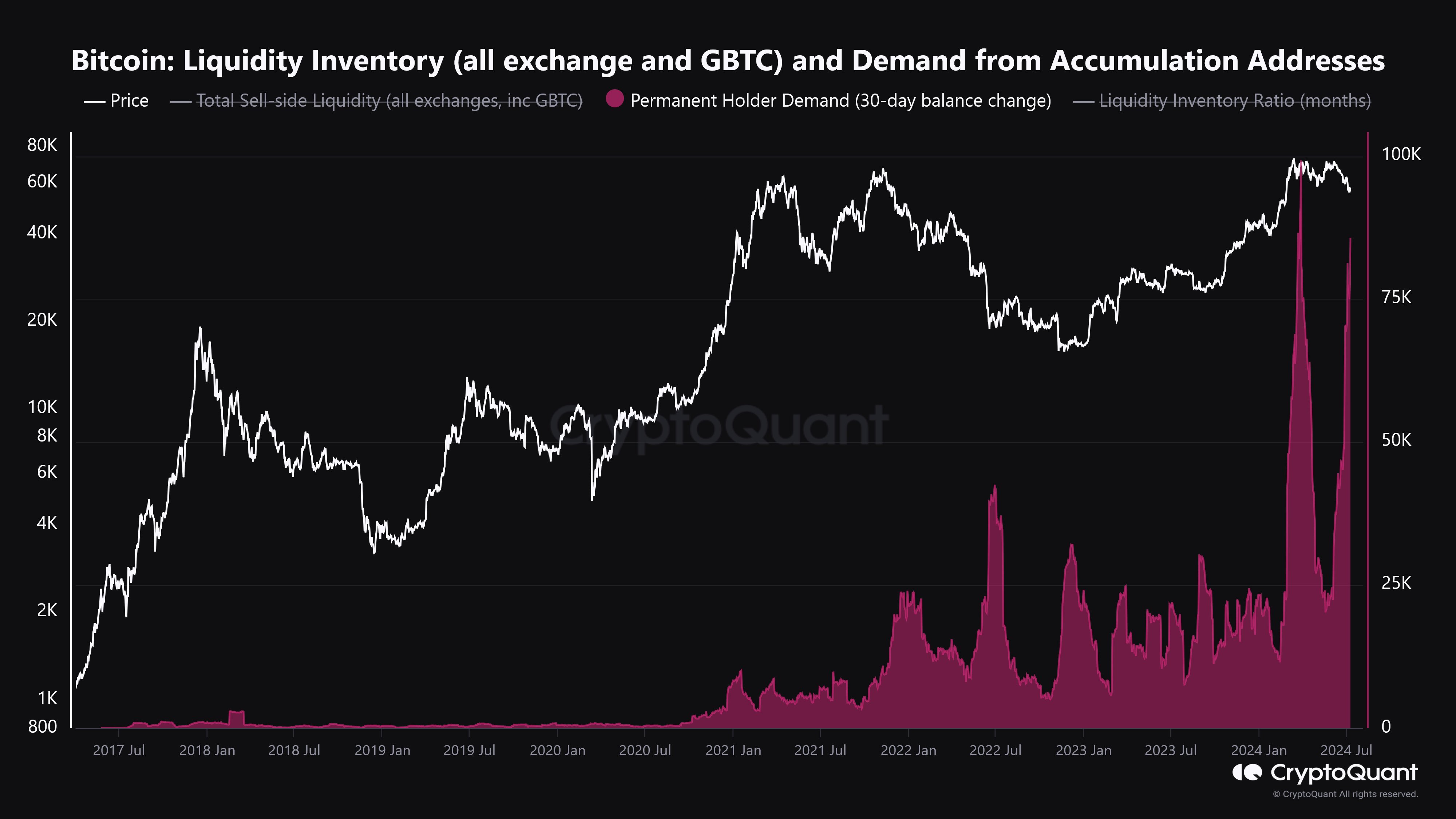

Bitcoin whales haven’t accumulated this much Bitcoin over a 30-day period since April 2023, shortly after several local banks in the United States collapsed.

Bitcoin whales took full advantage of the crypto market slump earlier this month, accumulating 71,000 Bitcoin amid the fastest rate of Bitcoin stacking since April 2023.

Much of that Bitcoin (BTC) — worth $4.3 billion at current prices — was scooped up when Bitcoin retraced to $54,200 on July 5, a chart from cryptocurrency analytics firm IntoTheBlock shows.

CryptoQuant notes that Bitcoin whales have now been stacking Bitcoin at the fastest rate (on a 30-day moving average) since April 2023, shortly after several local banks in the US collapsed.

Bitcoin demand from accumulation addresses. Source: CryptoQuant

“This suggests that the bottoming out of #BTC may be nearly complete,” CryptoQuant analyst Minkyu Woo added in a separate X post.

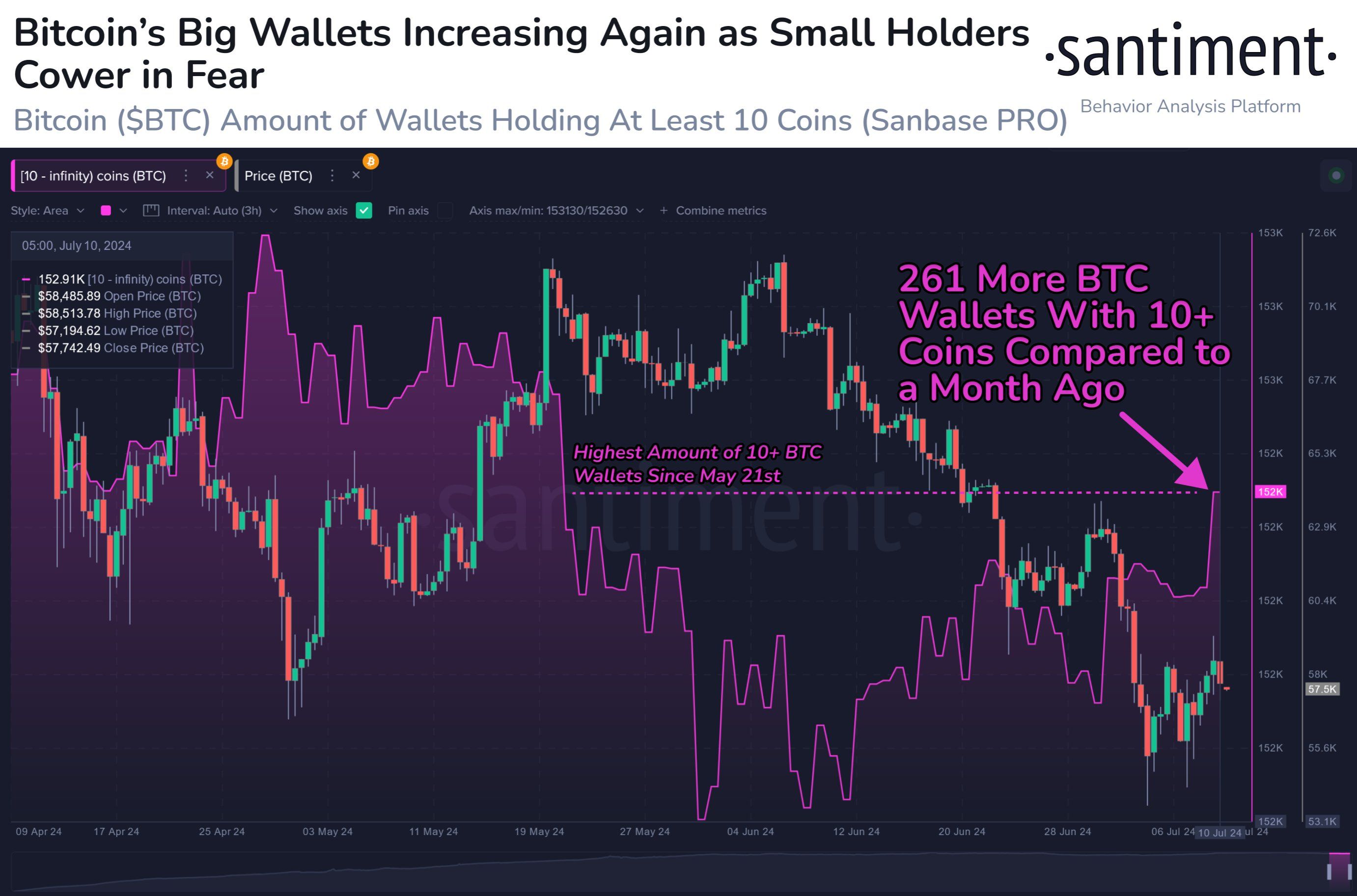

Meanwhile, smaller traders have been selling off their bags during the current dip, noted cryptocurrency analytics firm Santiment.

Santiment also observed a 261 net increase in the number of Bitcoin wallets holding at least 10 Bitcoin over the first 10 days of July.

“[This] should give traders comfort in a long-term bullish future.”

Number of Bitcoin wallets with at least 10 Bitcoin. Source: Santiment

It appears not all Bitcoin whales are planning to stack and hodl (hold on for dear life), though.

One dormant Bitcoin whale woke up on July 14 after a 12-year hiatus, transferring 1,000 Bitcoin worth nearly $60 million to two new wallets, according to Whale Alert.

Bitcoin is currently trading at $60,850, down 8.1% over the last month.

Mt. Gox preparing to offload $8 billion to its creditors and the German government selling nearly 50,000 Bitcoin — worth $3 billion — have largely fueled the price slump, industry pundits say.

However, Bitcoin started showing signs of a price recovery over the weekend, breaking the $60,000 resistance barrier and increasing 6% since trading hours closed on Friday.

This included a sharp increase immediately after US presidential candidate Donald Trump survived an assassination attempt while speaking on stage at a rally in Butler, Pennsylvania, on July 13.

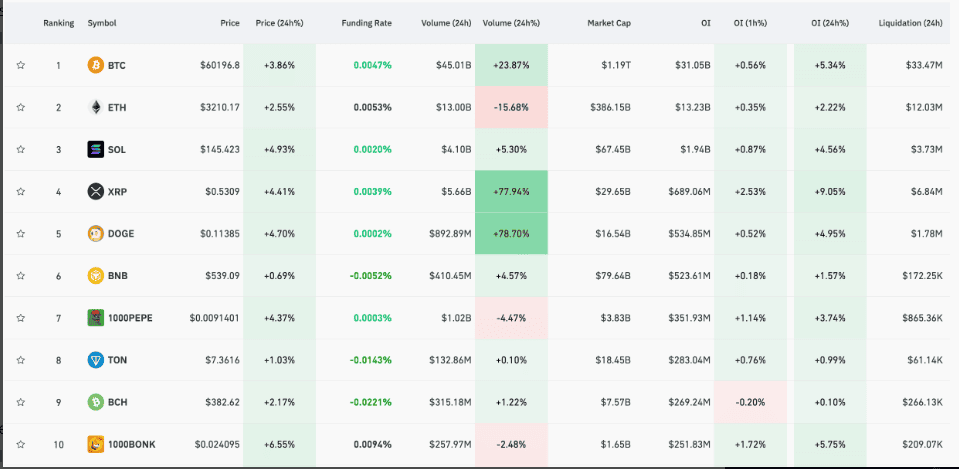

Crypto derivatives market is bullish

The open interest (OI) of all top-ranking cryptocurrencies has risen in the past 24 hours, especially after the Trump news. Moreover, most of these assets show positive funding rates, suggesting long traders pay a fee to short trades to keep their bullish positions open.

Top 10 crypto assets and their derivatives data. Source: Coinglass

The rise in OI and positive funding rates suggest that most traders have a strong bullish sentiment. They are willing to pay a premium to maintain their long positions, reflecting their confidence in the market's upward movement.

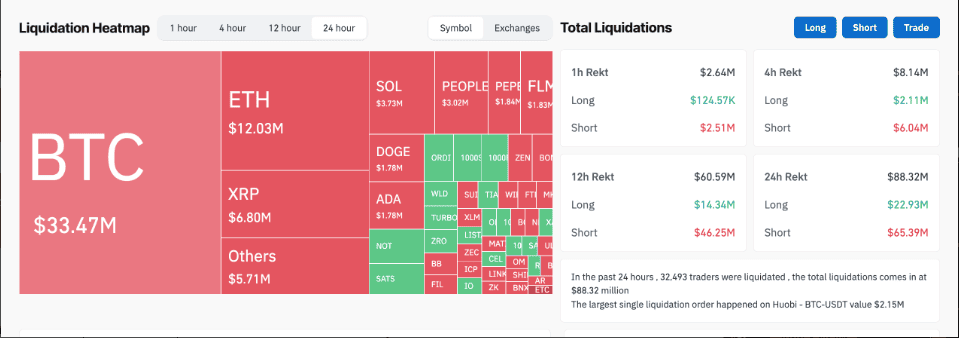

Furthermore, the crypto market's gains in the past 24 hours coincide with the relatively higher liquidation of short traders than the long ones. As of July 14, the market had witnessed $65.41 million worth of short liquidations compared to $22.93 million in long liquidations.

Crypto liquidation heatmap. Source: Coinglass

When a short position is liquidated, the trader must buy back the asset to cover their position. This buying pressure increases the demand for the asset, driving up its price.

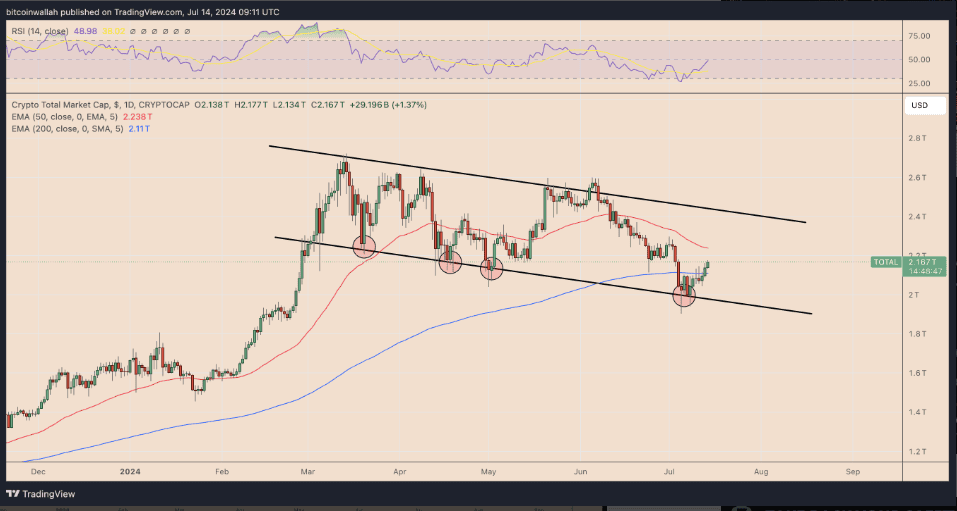

Descending channel bounce

From a technical perspective, today’s crypto market gains are part of a consolidation trend inside a prevailing descending channel pattern.

TOTAL crypto market cap. Source: TradingView

The crypto market tested the channel's lower trendline as support for the fourth time since March, a move that has lately preceded sharp rebounds. As of July, the market is visibly repeating the fractal, eyeing the 50-day exponential moving average (50-day EMA; the red wave) at around $2.23 trillion as its immediate upside target.

A decisive close above the 50-day EMA could have the market pursue a run-up toward the channel’s upper trendline, akin to its recent bounces. The upper trendline aligns with $2.42 trillion, which served as support during the May-June 2024 session.

cointelegraph

All information on our website is for general reference only, investors need to consider and take responsibility for all their investment actions. Info Finance is not responsible for any actions of investors.

Related news

29 Jun 2025