Share

Homepage

News

Fed’s Positive News: U.S. CPI Rises Less Than Expected

Fed’s Positive News: U.S. CPI Rises Less Than Expected

13 tháng 3 2025・ 03:29

The cost of goods and services in the U.S. rose at a slower-than-expected pace in February, as consumers and businesses remained wary of the inflationary impact of tariffs.

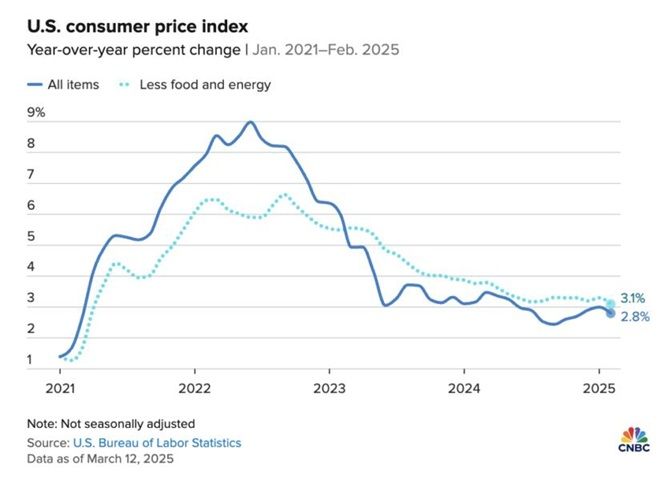

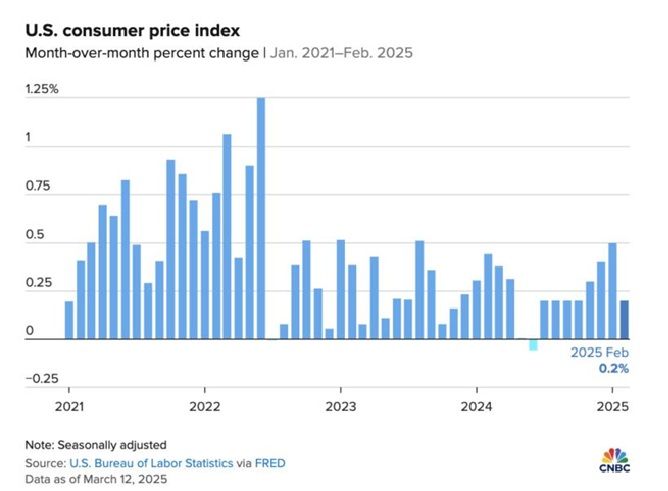

According to a report from the U.S. Bureau of Labor Statistics, the Consumer Price Index (CPI) increased by 0.2% month-over-month and 2.8% year-over-year, both 0.1 percentage points below forecasts.

Excluding food and energy, the core CPI also rose 0.2% on the month, falling short of economists' expectations of 0.3%. On a year-over-year basis, core CPI climbed 3.1%, slightly below the 3.2% forecast.

Markets React Positively

U.S. equity markets responded positively to the news, with futures gaining across the board.

In February, housing costs rose by 0.3%, a softer increase compared to January, though still accounting for nearly half of the CPI’s monthly gain. Housing costs make up over one-third of the CPI basket.

Food and energy indices both rose 0.2%. Notably, used car prices surged 0.9%, while apparel prices climbed 0.6%.

In the food category, egg prices soared 10.4% from the previous month, marking a staggering 58.8% increase year-over-year. This surge pushed the broader food index, including meat, poultry, and fish, up 7.7% from a year ago. Beef prices also rose 2.4% in February.

Economic Crossroads Amid Trade Tensions

This report comes at a critical juncture for the U.S. economy and financial markets. Recently, equity markets have suffered sharp declines as President Donald Trump escalated trade tensions, fueling recession fears among investors.

On March 12, Trump’s 25% tariff on steel and aluminum took effect, prompting retaliatory measures from the European Union.

Fed officials are closely monitoring these developments. Policymakers generally view tariffs as having a modest, one-off impact on inflation, with limited long-term effects on key economic indicators.

However, an expanded trade war could alter that outlook if price increases become more entrenched in the economy. Markets currently anticipate the Fed to cut rates in May, with a total of 75 basis points in reductions expected for 2025.

"The February CPI report provides further evidence of progress in core inflation, with price pressures easing following January’s strong data," said Kay Haigh, Co-Global Head of Fixed Income and Liquidity Solutions at Goldman Sachs Asset Management. "While the Fed is likely to hold rates steady at this month’s meeting, the combination of cooling inflation and growth slowdown risks suggests the central bank may need to continue its easing cycle."

Fed’s Next Moves & Growth Outlook

The Fed is set to meet next week and is widely expected to maintain its benchmark rate at 4.25%-4.5%.

Meanwhile, according to the Atlanta Fed’s GDPNow model, the U.S. economy could contract by 2.4% in Q1 2025, marking the first quarterly decline in three years.

By: Vu Hao

Trans: Info Finance

All information on our website is for general reference only, investors need to consider and take responsibility for all their investment actions. Info Finance is not responsible for any actions of investors.