Share

Homepage

News

Is Schlumberger (NYSE:SLB) A Risky Investment?

Is Schlumberger (NYSE:SLB) A Risky Investment?

20 tháng 7 2024・ 10:17

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Schlumberger Limited (NYSE: SLB) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

What Is Schlumberger's Debt?

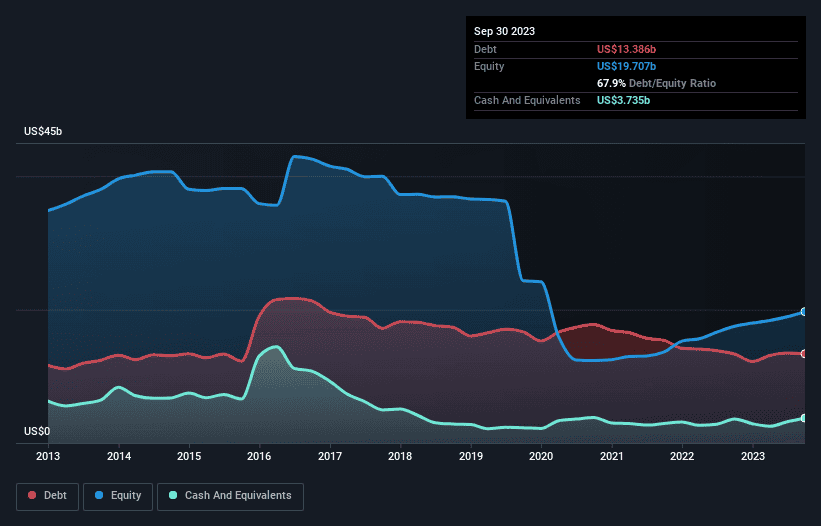

The chart below, which you can click on for greater detail, shows that Schlumberger had US$13.4b in debt in September 2023; about the same as the year before. However, it also had US$3.74b in cash, and so its net debt is US$9.65b.

A Look At Schlumberger's Liabilities

Zooming in on the latest balance sheet data, we can see that Schlumberger had liabilities of US$12.5b due within 12 months and liabilities of US$13.6b due beyond that. Offsetting these obligations, it had cash of US$3.74b as well as receivables valued at US$8.05b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$14.3b.

Of course, Schlumberger has a titanic market capitalization of US$75.1b, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Schlumberger has a low net debt to EBITDA ratio of only 1.4. And its EBIT easily covers its interest expense, being 13.1 times the size. So we're pretty relaxed about its super-conservative use of debt. On top of that, Schlumberger grew its EBIT by 43% over the last twelve months, and that growth will make it easier to handle its debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Schlumberger can strengthen its balance sheet over time.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, Schlumberger produced sturdy free cash flow equating to 59% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

Schlumberger's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under-14 goalkeeper. And the good news does not stop there, as its EBIT growth rate also supports that impression! Zooming out, Schlumberger seems to use debt quite reasonably, and that gets the nod from us. After all, sensible leverage can boost returns on equity. There's no doubt that we learn most about debt from the balance sheet.

Source: https://simplywall.st/

Related news

Market

14 Mar 2025

Asia-Pacific markets rise despite fall in Wall Street following escalation in Trump’s tariff threats

Market

13 Mar 2025

S&P 500 futures fall even after index posts first winning session in three: Live updates

Market

13 Mar 2025

Fed’s Positive News: U.S. CPI Rises Less Than Expected

Market

13 Mar 2025

Binance secures ‘largest investment ever’ in crypto as Abu Dhabi’s MGX pledges $2 billion

Market

12 Mar 2025

Dow Drops More Than 450 Points, S&P 500 Posts Back-to-Back Loss Over Trump Tariff Uncertainty

Warning

12 Mar 2025