Share

Homepage

News

Morgan Stanley Just Raised Its Price Target on Nvidia (NVDA) Stock

Morgan Stanley Just Raised Its Price Target on Nvidia (NVDA) Stock

02 tháng 7 2024

Morgan Stanley just hiked its NVDA price target on 'robust' data for chips

- Nvidia (NVDA) stock is up after Morgan Stanley raised its price target on the chipmaker.

- Analyst Joseph Moore raised his price target on NVDA to $144 per share from $116 while maintaining an “overweight” rating.

- Moore was specifically impressed with the sustained demand for Nvidia’s H100 and H200 chips.

Nvidia (NASDAQ:NVDA) stock is in the green today after one Morgan Stanley analyst raised its price target on Nvidia following the release of “robust” data.

Well, according to Morgan Stanley analyst Joseph Moore, recent checks from Taiwan and China have reaffirmed the investment bank’s faith in the chipmaker.

“The data points that we talked about in our two Asia notes, as well as our US checks, remain robust,” Moore noted, per SeekingAlpha.

Specifically, the analyst was impressed by continued demand for Nvidia’s Hopper products, which include its H100 and H200 GPUs. These GPUs are used extensively in generative artificial intelligence (AI) and high-performance computing, especially in the data centers. Moore estimates sales of both products will remain solid in both Taiwan and China.

Moore raised his price target to $144 per share from $116 while maintaining an “overweight” rating. This represents roughly 16% upside from NVDA stock’s current $124 price tag.

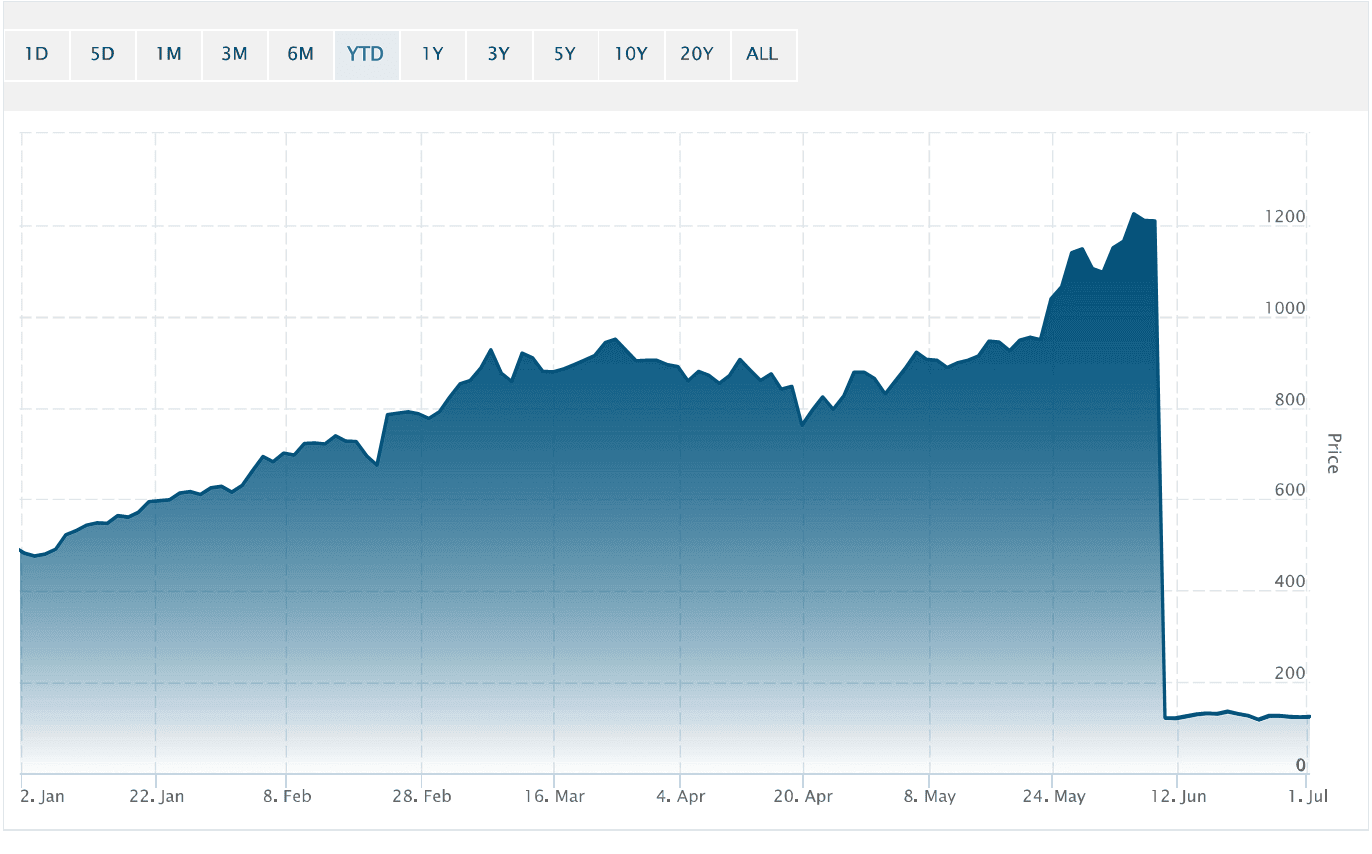

NVDA stock price

Moore also raised its earning expectations for the company, estimating Nvidia will earn $3.34 per share on a GAAP basis and $3.53 per share on an adjusted basis. That’s up from previous estimates of $2.91 per share and $3.10 per share, respectively.

NVDA Stock Continues to Climb in Record Year for Chipmaker

Indeed, NVDA stock is up a staggering 158% so far this year as a result of shockingly strong earnings numbers and a general AI frenzy on Wall Street.

Nvidia even overtook the likes of Microsoft (NASDAQ:MSFT) at one point this year to become the most valuable company in the world by market capitalization.

With AI only continuing to gain more prominence in the tech world, Nvidia remains a favorite of many analysts, including Moore.

investorplace

All information on our website is for general reference only, investors need to consider and take responsibility for all their investment actions. Info Finance is not responsible for any actions of investors.

Related news

29 Jun 2025