Share

Homepage

News

S&P 500 and Nasdaq Composite Break Eight-Day Winning Streak

S&P 500 and Nasdaq Composite Break Eight-Day Winning Streak

21 tháng 8 2024・ 03:48

U.S. Stocks Turn Lower on Tuesday (August 20), Ending the Rally as Investors Struggle to Extend the Market's Recent Recovery.

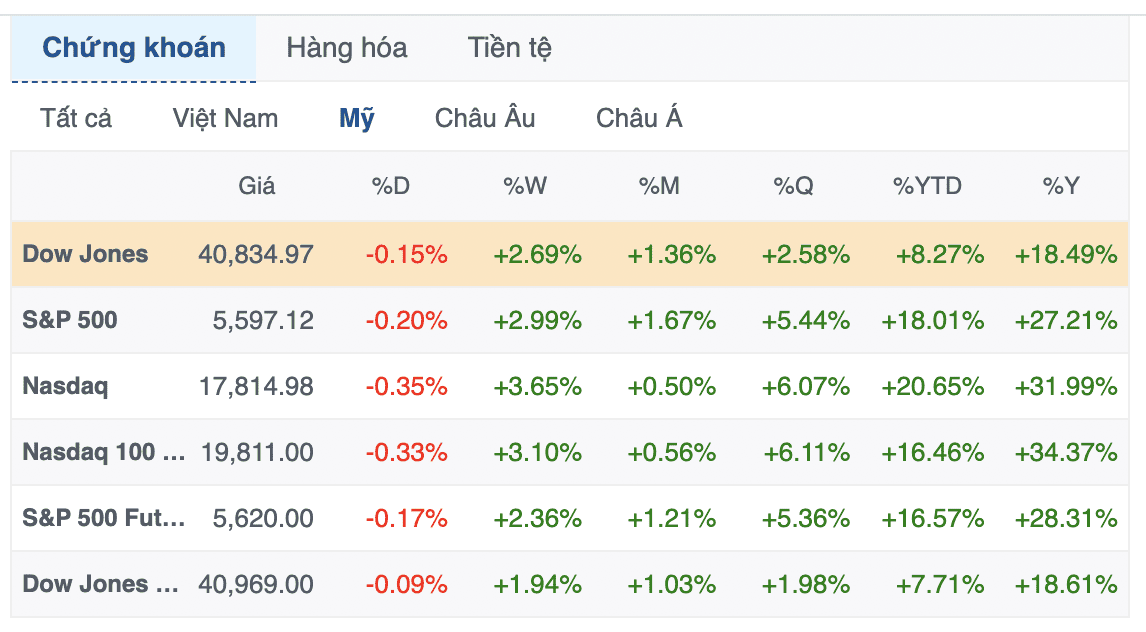

On August 20, the Dow Jones Industrial Average dropped 61.56 points (or 0.15%) to 40,834.97 points. The S&P 500 declined 0.2% to 5,597.12 points, while the Nasdaq Composite fell 0.33% to 17,816.94 points.

Tuesday's decline ended an eight-session winning streak for both the S&P 500 and the Nasdaq Composite, marking the longest rally for these indices since late 2023. Had the S&P 500 gained on Tuesday, it would have been its longest streak since 2004. Meanwhile, the Dow Jones recorded its first loss in six sessions.

Despite Tuesday's pullback, major indices have rebounded, and market volatility has decreased since the beginning of the month. The CBOE Volatility Index (VIX), Wall Street's best measure of fear, closed below 16 after surging above 65 on August 5, which was also the day the S&P 500 experienced its worst session since 2022 amid a global sell-off triggered by weak U.S. July jobs data and rising interest rates in Japan.

However, strong retail sales data and easing inflation reports released last week have calmed investor concerns about the economy. The S&P 500 and Nasdaq Composite are both up more than 1% this month, signaling a strong market shift.

This week, investors are gearing up for the Federal Reserve's annual Jackson Hole Economic Symposium, where Fed Chair Jerome Powell is expected to speak on August 23. Before that, investors will review the minutes from the Fed's July policy meeting, which will be released on August 21.

Wall Street is looking for clues on what will happen at the Fed's next policy meeting. According to the CME FedWatch tool, the market is anticipating a rate cut, with the only debate being whether the central bank will cut rates by 0.25% or 0.5% in September.

Related news

Market

13 Mar 2025

S&P 500 futures fall even after index posts first winning session in three: Live updates

Market

13 Mar 2025

Fed’s Positive News: U.S. CPI Rises Less Than Expected

Market

13 Mar 2025

Binance secures ‘largest investment ever’ in crypto as Abu Dhabi’s MGX pledges $2 billion

Market

12 Mar 2025

Dow Drops More Than 450 Points, S&P 500 Posts Back-to-Back Loss Over Trump Tariff Uncertainty

Warning

12 Mar 2025